Zillow: Homes Owned by Black Families Appreciated Fastest During Pandemic

Homes owned by Black families appreciated more than any others since the start of the pandemic, with the typical Black homeowner gaining nearly $84,000 in equity, reported Zillow, Seattle.

Zillow noted Black Americans also made slight gains in homeownership rates despite disproportionate job and income loss.

The gap between the typical Black-owned home’s value and the value of the typical U.S. home is now the smallest it’s been in more than two decades, Zillow said.

“These gains are extremely important in terms of increasing wealth among the Black community, as homeowners of color are more likely to have the bulk of their household wealth tied up in their homes,” said Nicole Bachaud, Senior Economist with Zillow. “Due to years of redlining and other forms of systemic discrimination, housing disparities between Black and white families persist. Policies and interventions like expanding access to credit, building more affordable homes and finding new approaches to mitigate appraisal bias are keys to achieving housing equity.”

(The Mortgage Bankers Association’s CONVERGENGE Initiative is a place-based partnership focused on narrowing the racial homeownership gap. CONVERGENCE Philadelphia will launch on March 15, joining CONVERGENCE initiatives in Memphis, Tenn., and Columbus, Ohio.)

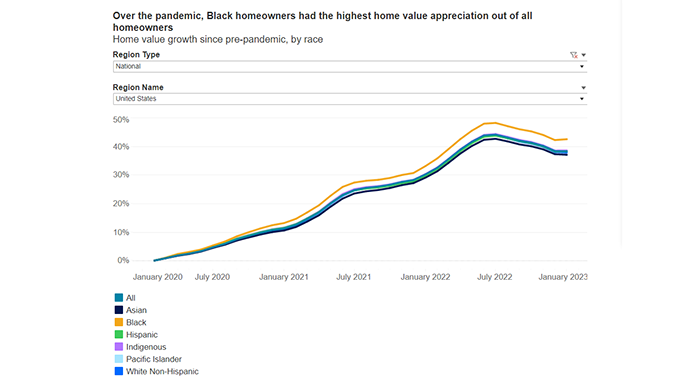

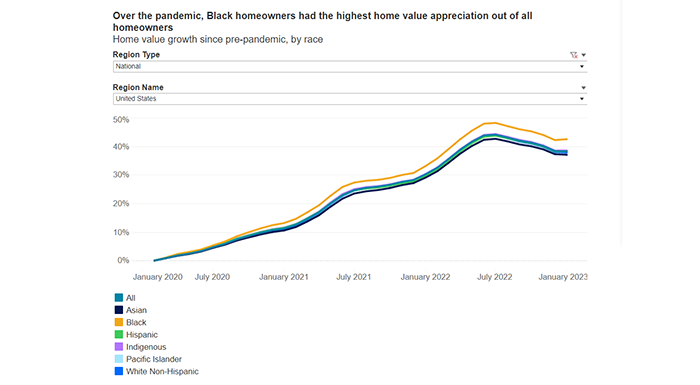

Between February 2020 and January 2023, Black homeowners saw their home values increase 42.5% compared to 38.5% for U.S. home values overall and 37.8% for white-owned home values, Zillow reported. Hispanic- and Asian-owned home values increased by 38.3% and 37%, respectively.

“Home value appreciation among Black homeowners has outpaced all other races since 2014, and that trend accelerated at the start of the pandemic, further shrinking the home value gap,” the report said. In February 2020, the typical Black-owned home was worth 17.3% less than the typical home overall. By January 2023, that gap closed to 14.8%, which is the closest Black-owned home values have been to overall values since at least the year 2000.

That home value gap has shrunk the most in Detroit among the 50 largest metros–a full 9 percentage points since February 2020. Kansas City, Chicago, Cleveland, Milwaukee and Louisville, among other markets, also saw large improvements, with the gap closing by more than 5 percentage points in that time.

The U.S. Census Bureau said 44% of Black households now own their homes, compared with 73.3% of white households. Zillow noted Black homeownership increased 2 percentage points from 2019 to 2021, compared to 1.3% for the nation at large.

“Still, for many Black Americans, barriers to accessing homeownership abound,” the report said. “Many markets with the highest appreciation in Black home values also have the highest mortgage denial rates for Black applicants, meaning the markets where Black homeowners have the best chance of improving their household wealth and gaining equity with homeowners overall are markets where it’s most difficult for Black mortgage applicants to actually become homeowners.”