Fitch: Rising Rates, Inflation Weigh on Insurance Sector

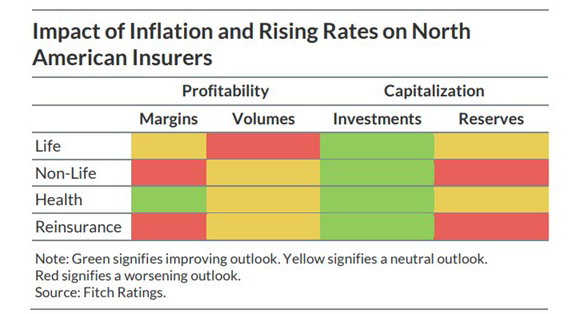

Fitch Ratings, Chicago, said inflationary pressures and a potential modest recession could pave the way for a revision of sector outlooks to “Deteriorating” for North American insurers before the year is out.

Fitch Senior Direcgtor Doug Pawlowski said the revised outlook is based on a set of relatively conservative economic assumptions. “The rising rate of inflation and the threat of a modest recession will outweigh the benefits of a rising interest rate environment on investment performance, and the assumption that non-life insurers will be able to adequately reprice business,” he said.

The report said inflation is a greater risk for non-life insurers. Reasons for the increased susceptibility to inflation include longer-term higher inflation that in turn affects claims drivers, such as property repairs, medical care and litigation costs, creates challenges in adequately pricing business and accurately setting reserves. Ongoing favorable commercial lines pricing, adequate current loss reserves and very strong statutory capitalization position the industry to navigate near-term volatility tied to inflation.

However, Fitch said the life insurance sector is set to benefit from rising interest rates. “That said, a rapid rise in rates beyond Fitch’s expectations would present challenges for lines of business without strong protection from spikes in lapses or surrenders,” the report said. “Inflation is less of a concern for life insurers although certain product guarantees may lead to increases in benefit payments in limited situations, such as in the long-term care line.”