FHA 2022 Actuarial Report Shows Continued Improvements in Capital Ratio, HECM Performance

The Federal Housing Administration on Nov. 15 released its Annual Actual Report on the status of its Mutual Mortgage Insurance Fund, showing an increase in congressionally mandated capital reserve ratios, lower delinquency levels and a decrease in borrowers in forbearance plans.

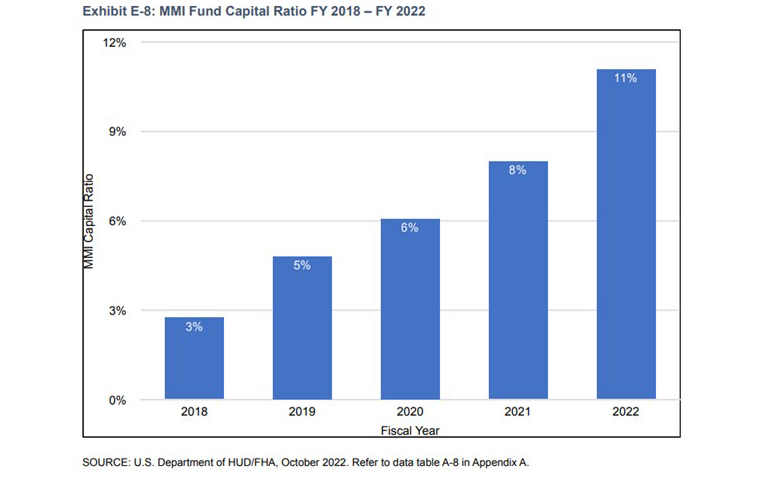

The report showed as of September 30, the MMI Fund Capital Ratio improved to 11.11 percent of Insurance-in-Force, representing an increase of 3.08 percentage points from the FY 2021 MMI Fund Capital Ratio of 8.03 percent and marking the fourth consecutive yearly improvement.

The report also noted the stand-alone capital ration for the FHA Home Equity Conversion Mortgage (HECM) program improved for the fourth straight year and is now positive for the first time since 2015. HECMs comprise 5 percent of the MMI portfolio.

“I’m so proud of FHA’s work to make homeownership possible for our nation’s underserved households and communities,” said Federal Housing Commissioner Julia R. Gordon. “Behind the bottom-line numbers are some two million individuals and families who were able to achieve homeownership or stay in their homes through hard times thanks to assistance from FHA.”

MBA President and CEO Bob Broeksmit, CMB, issued the following statement:

“Today’s report reflects a very healthy FHA program, with continued strengthening of the FHA Mutual Mortgage Insurance Fund, lower delinquency levels and fewer borrowers in pandemic-related forbearance.

“Thanks to prudent risk management over the past several years by HUD and FHA lenders, the Fund’s capital reserve ratio is more than five times the statutory minimum reserve ratio and is well positioned to withstand an economic slowdown. We commend HUD and mortgage servicers for their ongoing work together during the pandemic to help homeowners successfully exit forbearance programs and stay in their homes.

“Given FHA’s healthy financial position, MBA continues to believe that HUD should make FHA loans more affordable by reducing mortgage insurance premiums as soon as budgetary opportunities allow. This move would help offset the impact of higher mortgage rates and improve the purchasing power for many prospective first-time homebuyers, minority buyers, and those with low and moderate incomes.

“With further slowing in the housing market expected in the months ahead, MBA will work with HUD and FHA leadership to ensure FHA can safely and sustainably perform its countercyclical role in the market, particularly for first-time homebuyers and underserved communities.”

The report said FHA helped more than one million homeowners who were behind on their mortgage payments to obtain an FHA COVID-19 Forbearance and/or an FHA COVID-19 Recovery option to stay in their homes despite the dislocations caused by the pandemic. In FY 2022, FHA reduced the number of serious delinquencies – mortgages 90 or more days past due – by nearly half, ending with a serious delinquency rate of 4.77 percent on September 30. This number had reached more than 11 percent during the height of the COVID-19 crisis.

Other report highlights:

–The overwhelming majority of FHA insurance endorsements, 84% of its total forward purchase mortgage endorsements (678,675 mortgages), were for mortgages made to first-time homebuyers. The share of FHA’s fiscal year 2022 total purchase mortgage endorsements on mortgages for first-time homebuyers was 37 percentage points higherthan that of other participants in the U.S. housing market.

–FHA provided an insurance endorsement on mortgages for 284,807 self-identified individuals and families of color, 29% of its total forward mortgage insurance endorsements. FHA served three times as many Black borrowers by share of its total forward mortgage insurance endorsements than the rest of the market, and two times as many Hispanic borrowers by share than the rest of the market, according to 2021 Home Mortgage Disclosure Act data.

–From the start of the pandemic through September 30, more than one million borrowers with FHA-insured mortgages took advantage of loss mitigation home retention options or were in the process of obtaining loss mitigation through their mortgage servicer. More than 566,000 homeowners received a COVID-19 Recovery Standalone Partial Claim through their mortgage servicer throughout fiscal year 2022. FHA said its other loss mitigation home retention options have helped nearly 445,000 borrowers to regain their financial footing and avoid foreclosure over the course of fiscal year 2022.

–As of September 30, FHA’s serious delinquency rate, the percentage of mortgages 90 or more days delinquent, fell to 4.77%, a decrease of four percentage points over the past year year and a reduction of more than seven percentage points from the peak of 11.90% experienced in November 2020.

–The overall Capital Ratio of the Fund increased by three percentage points over the previous fiscal year, ending at 11.11% as of September 30. FHA’s forward mortgage portfolio achieved a stand-alone capital ratio of 10.47% as of September 30, a 2.48 percentage point increase over fiscal year 2021. The FHA HECM portfolio’s stand-alone capital ratio stood at 22.77% as of September 30, a 16.69 percentage point increase from fiscal year 2021, due in part to the permanent allocation to the HECM portfolio of $1.7 billion in appropriated funds received by FHA in fiscal year 2013.

–The MMI Fund has $147.7 billion in MMI Capital, a $41.2 billion increase from fiscal year 2021.