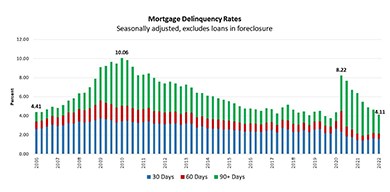

MBA: 1st Quarter Mortgage Delinquencies Decrease

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.11 percent of all loans outstanding in the first quarter, the Mortgage Bankers Association’s National Delinquency Survey reported.

To the Point with Bob: How Policymakers Can Empower Mortgage Lenders To Deliver More Relief To Borrowers

It is important to recognize how well U.S. mortgage markets have performed for borrowers, delivering record-low rates to millions of homeowners who refinanced, meeting mortgage demand in a booming housing market and keeping millions of Americans in their homes during the pandemic through the wide-scale implementation of forbearance plans.

FHFA Announces Mandatory Supplemental Consumer Information Form Use

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will require lenders to use the Supplemental Consumer Information Form as part of the application process for loans that will be sold to the Enterprises.

CFPB: ECOA Protects Borrowers After Applying for, Receiving Credit

The Consumer Financial Protection Bureau on Monday published an advisory opinion affirming the Equal Credit Opportunity Act—a federal civil rights law protecting individuals and businesses against discrimination in accessing and using credit—bars lenders from discriminating against customers after they have received a loan, not just during the application process.

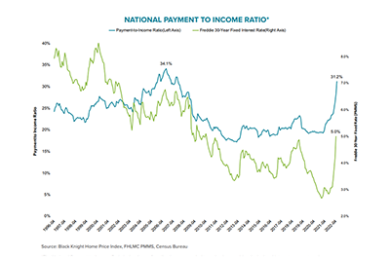

Borrower Behavior Changing as Home Affordability Drops

Though home price appreciation slowed slightly in March, 30-year mortgage interest rates above 5 percent have pushed affordability to nearly its worst-ever level, said Black Knight, Jacksonville, Fla.