Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.

The report noted through the COVID-19 pandemic, consumer performance remained relatively strong as stimulus funds, forbearance and accommodation programs provided consumers with a safety net during a period of great uncertainty. Now that pandemic financial programs have ended, new challenges such as inflation and rising interest rates are starting to have an impact on consumer spending power.

The report also said while prices are increasing, consumer spending has not yet recovered to the pre-pandemic levels. The average credit card balance hovered around $5,010. While this was a 4.7% increase over Q1 2021 ($4,784) it still lagged 11% behind the average balance in Q1 2020 ($5,637). Total credit card balances for the industry are $769 billion, which is 5.5% below the $814 billion observed in Q1 2020.

In addition to consumer spend approaching pre-pandemic levels, TransUnion said consumer liquidity also remains stable. Aggregate excess payment – the excess amount a consumer makes over the minimum amounts due on all their credit accounts – is typically an indication of a consumer’s ability to manage their overall debt payments. In Q1 2022, average AEP was $328, remaining relatively flat from the $326 observed in Q1 2021. The current level remains above the average AEP levels seen pre-pandemic.

“Compared to a year ago, the price of everything from filling a gas tank to buying a carton of eggs has increased due to inflation,” said Michele Raneri, vice president of research and consulting with TransUnion. “Since wages of many consumers have not kept up with inflation, people are spending more to get less. However, there are several positives to note, including low unemployment, lenders increasing access to credit and strong consumer performance. These are all indications that consumers are well positioned as the economy continues to find its footing from the financial volatility of the pandemic.”

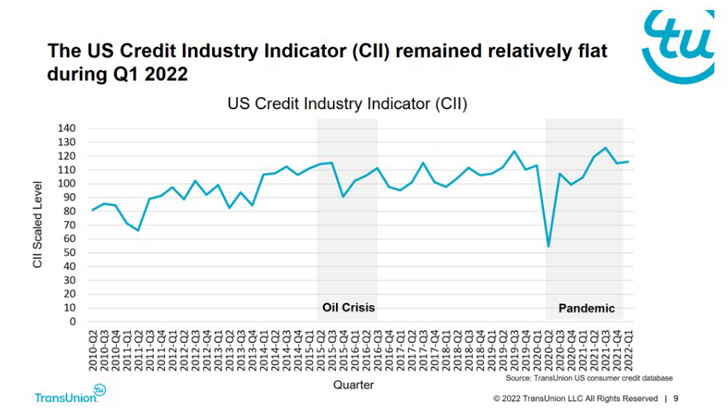

Another sign that consumer credit health remains healthy: TransUnion’s Credit Industry Indicator increased to 116 in Q1 2022 – up from 115 in the previous quarter and 105 one year ago. In addition to consumer credit health maintaining a healthy level, there has not been a material impact to consumer performance. Serious delinquency rates across mortgage, auto, credit card and personal loans have stayed relatively flat in the wake of expired forbearance programs or rolled back accommodation programs.

“Consumers are continuing to perform well on their credit and debt obligations – even when faced with several macroeconomic factors that are influencing affordability. Factors such as rising interest rates could affect the monthly payment amounts for some consumers, but we are currently seeing that they are continuing to make payments, sometimes even in excess, of what is required,” Raneri said.

On the mortgage side, TransUnion said rising interest rates and limited housing supply have caused the mortgage origination market to slow, with volumes declining to 2.9 million originations in Q4 2021 – a -28% YoY decrease but a number still well above the 2.3 million observed pre-pandemic in Q4 2019. Rate and term refinance originations dropped dramatically by 58% YoY resulting in the continued increase of purchase share of originations for the third consecutive quarter up from 47% in Q4 2020 to 56% in Q4 2021. Tappable home equity, however, continues to grow and reached an all-time high of approximately $20 trillion in Q4 2021. Additionally, homeowners are showing sustained interest in taking advantage of the equity they have built with total home equity originations up 4% YoY and 80% from 2018 to 1.2 million. Within home equity originations, cash-out refinance decreased by only 6% YoY while HELOC grew 31% YoY in Q4 2021 and 13% YoY for a Home Equity Loan. Rising home prices have also pushed the average loan size of new mortgages to $315,543, an increase of 7% YoY.

“The rising interest rate environment has impacted mortgage origination volume,” said Joe Mellman, senior vice president and mortgage business leader with TransUnion. “There is less incentive to go through a rate and term refinance and for those looking to purchase a home, low inventory and high home prices presents a challenge. A marginal reduction in new cash-out refinance volumes and a substantial increase in HELOC and home equity loan originations indicates that for those who are already homeowners, the continued home price appreciation offers an opportunity to tap into growing home equity and gain access to cheaper capital. Mortgage lenders can bolster growth in a subdued market by leveraging tools that can identify and reach consumers who are in the market to tap their available home equity.”