CMBS Delinquency, Special Servicing Rates Dip in December

Chart credit: Fitch Ratings.

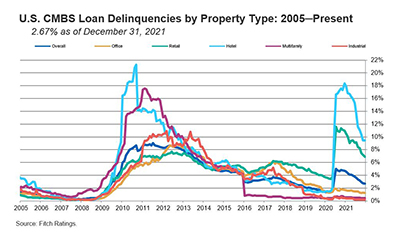

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

The CMBS delinquency rate equaled 4.67 percent at year-end 2020, Fitch said in its December CMBS Market Trends report.

Fitch said resolutions totaled $796 million in December, down from $1.2 billion in November. New delinquencies of $593 million were well below the $850 million monthly average for 2021.

Fitch noted it anticipates volatility in 2022 as 30-day delinquencies more than doubled to $2.7 billion in December from $1.1 billion in November.

The hotel sector had the highest percentage of delinquent loans at 9.43 percent, Fitch reported. Retail ranked second at 6.92 percent, followed by office at 1.23 percent, multifamily at 0.44 percent and industrial at 0.16 percent.

In its December delinquency report, Trepp LLC, New York, said several big office loans became 30 days delinquent during the month, including 245 Park Avenue in New York and 181 West Madison Street in Chicago. Looking at loans in their grace period, 2.13 percent of loans by balance missed their December payment but were less than 30 days delinquent. That was up eight basis points for the month.

Trepp reported the percentage of loans with a special servicer fell from 6.94 percent in November to 6.75 percent in December. Hotel loans had the highest special servicing percentage at 13.72 percent, though this figure dropped more than a full percentage point in December.

Kroll Bond Rating Agency, New York, said CMBS private-label pricing volume totaled $6.5 billion in December, bringing total 2021 issuance to $110 billion–more than double 2020 issuance volume. More than 20 deals could launch this month, including six to eight single-borrower transactions, four conduits, two Freddie Mac K-Series and as many as seven commercial real estate collateralized loan obligation transactions, KBRA said in its CMBS Trend Watch.