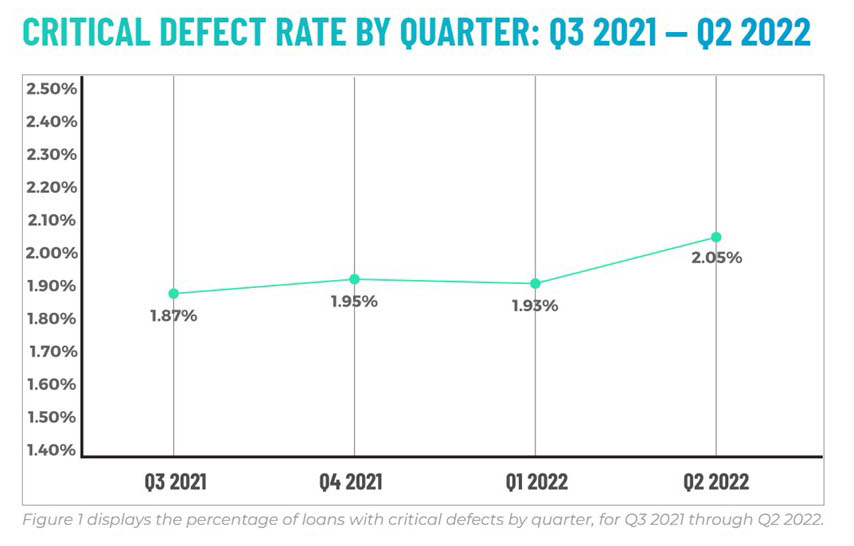

ACES: Critical Defect Rates Up 6%

ACES Quality Management, Denver, issued its quarterly Mortgage QC Industry Trends Report, showing the overall critical defect rate increased by 6% in the second quarter to 2.05%, crossing the 2% threshold for only the third time in this report’s history.

The report said while Income/Employment defects continued to represent the majority of defects reported, its overall share of defects decreased from the previous quarter. Loan Documentation defects increased significantly in the second quarter, with Closing Documentation errors comprising the vast majority of these defects.

The report said Appraisal defects continued trending downward for the second straight quarter, improving slightly from the first quarter. Purchase share increased in the quarter, reflecting the shift from a refinance market, while conventional loan share remained essentially unchanged.

The report also noted although FHA share increased slightly in second quarter, defects declined significantly in this category over the previous quarter. Conversely, VA and USDA defects increased remarkably despite only modest gains in review share, with VA defects more than doubling from the previous quarter.

“The geopolitical and macroeconomic events surrounding Q2 2022 are most certainly the driving factors behind the increase in the overall critical defect rate past the 2% threshold,” said ACES Executive Vice President Nick Volpe. “While the Income/Employment category improved tremendously this quarter, significant defect increases in the Loan Documentation, VA and USDA categories are cause for concern.”

Report findings are based on post-closing quality control data derived from the ACES Quality Management and Control benchmarking system and incorporate data from prior quarters and/or calendar years, where applicable.

“With interest rates skyrocketing and severe declines in volume and profitability, Q2 2022 was the perfect storm for the mortgage industry,” said ACES CEO Trevor Gauthier. “The market disruption combined with increased competition certainly created ample opportunity for loan defects, hence the increase in Q2r’s overall critical defect rate. The takeaway for lenders moving forward is to double down on quality control and risk mitigation to protect the volume they can capture and ensure buyback requests don’t diminish profits.”

The report is available at https://www.acesquality.com/resources/reports,