Q3 Fraud Risk Index Falls by 4.6%

CoreLogic, Irvine, Calif., said its National Mortgage Application Fraud Risk Index decreased by 4.6% in the third quarter, from 132 in the second quarter and from 126 a year ago.

The year-over-year trend is up 26.7%, from 99 a year ago.

The report said a small drop in interest rates was enough to push jumbo refinance volumes to spike in Q3, and overall volumes increased slightly for both refis and purchases. In Q3, purchases were 45.7% of transactions, similar to the prior quarter at 46.3%. The small shift to refinances and overall volume increase likely caused the 4.6% national index drop.

“In Q3, we also saw a reversal of the GSE financing limits for investment and second home properties,” said CoreLogic Principal Bridget Berg. “This seemed to lead to a surge in investment purchase transactions in the second half of September. The risk level that accompanied the surge showed a modest reduction in risk. We will continue to watch this segment, as it has a higher fraud risk level and there have been a number of changes in the last year in the availability of this financing.”

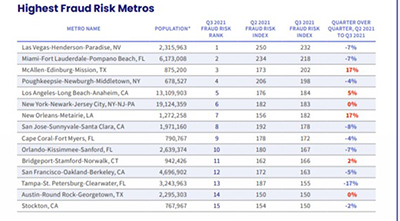

The report said nine of the 15 riskiest metros saw a fraud risk decrease from the second quarter. Las Vegas continues to hold the top spot, although its Risk Index fell by 7 percent, from 250 to 232. Miami/Fort Lauderdale held the second spot despite a 7 percent drop in its Risk Index, from 234 to 218. McAllen, Texas held third; its risk index jumped by 17 percent from 173 to 202. Rounding out the top five were Poughkeepsie, N.Y. (198) and Los Angeles (184). California and Florida metros each occupy four spots in the top 15.