CMBS Delinquency Rate Improvement Reaches 11-Month Mark

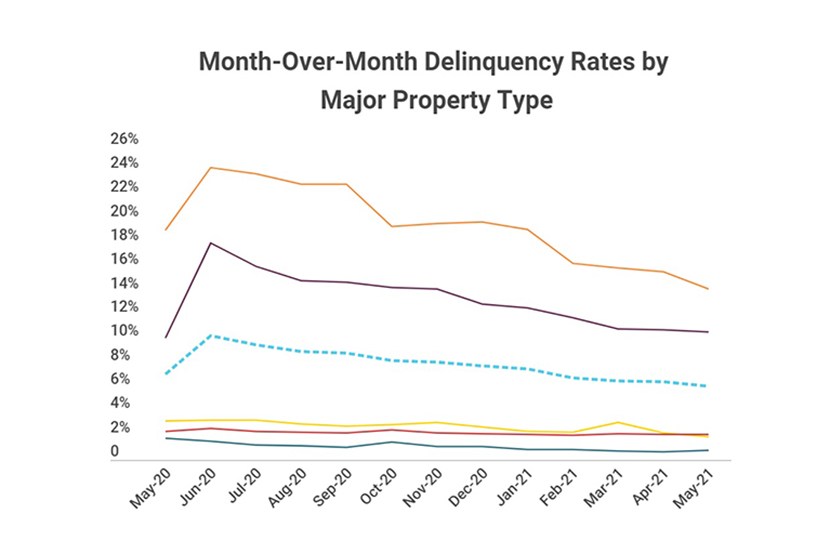

(Chart courtesy of Trepp)

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in May, posting its biggest drop in three months.

“After two huge jumps in May and June 2020, the rate has now declined for 11 consecutive months,” Trepp Senior Managing Director Manus Clancy said.

Clancy noted the commercial real estate market continues to heal following last year’s COVID-inflicted damage. “The hardest-hit parts of the market, lodging and retail, continue to see impressive declines in the percentage of delinquent loans,” he said. “As the economy continues to return to normal, these numbers should continue to fall.”

Last week the Mortgage Bankers Association reported the balance of commercial and multifamily mortgages not current decreased in May to its lowest level since the pandemic started.

“Because of the concentration of hotel and retail loans, commercial mortgage-backed securities loan delinquency rates are higher than other capital sources,” the MBA CREF Loan Performance Survey said. It reported 8.2 percent of CMBS loan balances were non-current in May, down from 8.5 percent a month earlier.

Going forward, Fitch Ratings, New York, said it expects CMBS loan refinanceability will remain “pressured” as the volume of CMBS maturities increases over the next 18 months. The ratings firm cited continued business interruptions at many properties, the “uneven” reopening of the country, depressed in-place cash flows and secular shifts caused by the coronavirus pandemic as refinancing pressure sources.

Fitch said nearly $7.5 billion of performing, non-defeased loans within its U.S. CMBS 2.0 conduit and Freddie Mac universe are scheduled to mature by year-end. Maturities are “manageable” over the next three quarters, with $1.6 billion maturing this quarter, $3.1 billion next quarter and $2.8 billion in the fourth, but then jump significantly to nearly $20 billion in 2022, Fitch said in its Near-Term Maturing U.S. CMBS Loans to Face Refinancing Challenges report.

Multifamily and industrial properties remained resilient throughout the pandemic, which will support these loans refinancing, Fitch said. “[But] many retail and hotel properties will have difficulty refinancing; those properties already struggling prior to the pandemic or those with limited rebound potential, or where sponsors no longer want to inject additional equity to carry the property, will default at or prior to their maturities,” the report said.

Fitch said it anticipates extensions will continue for loans maturing soon with committed borrowers and stabilization expectations.