As Hurricane Season Starts, 31 Million Homes ID’d as ‘High-Risk’

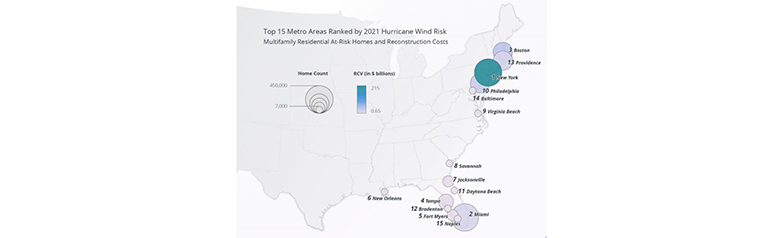

(Graphic courtesy of CoreLogic.)

June 1 marked the start of the 2021 hurricane season. The National Oceanic and Atmospheric Administration projected another “above-normal” season, with as many as 20 named storms, 6-10 hurricanes and 3-5 major hurricanes (Category 3 or higher).

While this might seem downright normal compared to 2020 (a record 30 named storms), CoreLogic, Irvine, Calif., said catastrophic risks remain high: its 2021 Hurricane Report identifies more than 31 million single-family homes (and nearly 1 million more homes in multi-unit buildings) that are at moderate or greater risk from the damaging winds of a hurricane. Nearly 8 million of these homes had direct or indirect coastal exposure and subsequent risk from coastal storm surge and damage from hurricanes.

And as past years have shown, the economic effects of these storms are equally devastating. Damage from “extreme” events such as Hurricane Katrina (2005) and Hurricane Harvey (2017) easily exceeded $100 billion; last year’s storms caused an estimated $51.4 billion in property damage.

For any one community, the report said, hurricane losses are severe and infrequent, and homeowners primarily rely on the availability of insurance proceeds to restore homes and support community resilience goals. Damage from hurricane winds is generally insured for most homes, but flood insurance is not uniformly purchased by homeowners. Studies by CoreLogic have shown that up to 70% of the damages from flood to homes is uninsured.

“This crisis highlighted an important distinction: while hurricanes are devastating for any community, the effects of disasters can be exponentially worse for lower-income areas,” CoreLogic said. “In understanding hurricane risk exposure, both today and in the future, financial devastation for insurers, homeowners and communities can be prevented.”

The report notes a climate change continues to reshape the way storms behave, the risk in

these hurricane-prone areas will continue to increase. Based on data from NOAA National Centers for Environmental Information, the past four decades have seen a 70-90% increase every decade in total inflation-adjusted losses from weather events in the United States — a trend that is not slowing down.

“Many of the increases are driven by population migrations from expensive metropolitan areas to high-risk, more affordable coastal areas,” the report said. “These areas are typically low-lying, hurricane prone and especially subject to the climate-related factors at play including, sea level rise, extreme rainfall events and possible increases in hurricane intensity.”

As hurricanes grow stronger, CoreLogic said, property losses will continue to mount and the insurance industry will see increased financial implications as wind damages are covered by standard homeowners insurance policies. “While flood insurance adoption inside the Special Flood Hazard Areas designated by FEMA is strong, it’s rarely purchased outside of those zones,” the report said. “This means many unsuspecting homeowners could be left with little-to-no protection in recovery from intensifying hurricane seasons.”

The report identified the New York City metropolitan area at highest risk for storm damage. It said 3.4 million single-family homes in the New York area are at risk for hurricane damage, and with nearly 782,000 homes at risk for storm surge. New York was followed by Miami (1.99 million homes at hurricane damage risk; 739,000 homes for storm surge risk); Tampa, 1.1 million, 544,000); New Orleans (424,000, 397,000) and Virginia Beach, Va. (579,000, 396,000).