ACES: Q4 Critical Defect Rate Moderates, But Remains High

(Chart courtesy ACES Quality Management.)

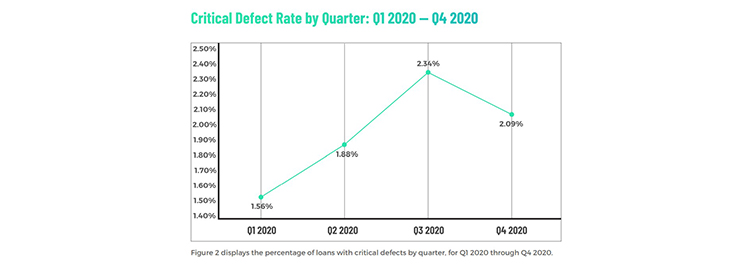

ACES Quality Management, Denver, said overall critical defect rates improved in the fourth quarter but remained high for calendar year 2020.

The quarterly ACES Mortgage QC Trends Report said the overall critical defect rate improved to 2.09% in the fourth quarter, lower than the prior quarter but still higher than other quarters in 2020.

The report said Loan Documentation defects rose in 2020, most likely driven by pandemic-related issues and symptomatic of manufacturing-related defects overall. Income/Employment defect share fell – a positive sign – but manufacturing-related defects grew.

“Amidst a positive interest rate environment and an improving economy, the critical defect rate moderated in Q4 2020,” said ACES Executive Vice President Nick Volpe. “The marginal decrease in critical defects is the first step in what we hope to be a downward trend.”

The report noted 2020 was dominated by refinances as a result of pandemic-driven historically/record low interest rates. Conventional loan share hit its highest point since ACES began publishing the QC Trends Report in 2016. Early Payment Defaults decreased in Q4 2020 and Q1 2021.

“Despite the distinct differences in the Fannie Mae defect categories of 2020 compared to previous years, the defect share for Income and Employment in 2020 was 23.95%, just above 2019’s defect share of 23.10%,” Volpe said. “Of the remaining core credit categories, liabilities is the only category to increase in 2020. This is a testament to the agility lenders showed last year, despite the continuing challenges lenders faced in maintaining loan quality.”

Findings for the Q4/CY 2020 ACES Mortgage QC Industry Trends Report are based on post-closing quality control data derived from the ACES Quality Management and Control benchmarking system and incorporates data from prior quarters and/or calendar years, where applicable. All reviews and defect data evaluated for the report were based on loan audits selected by lenders for full file reviews.

“It would be easy to say the last two quarters of 2020 were dismal, but considering the pandemic, unemployment and critical defect rates, our Q4 findings are buoyant,” said ACES CEO Trevor Gauthier. “Critical defect rates and early payment defaults will continue to be areas to watch closely, particularly as lenders respond to the changing landscape of 2021 and more borrowers come out of forbearance.”