CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

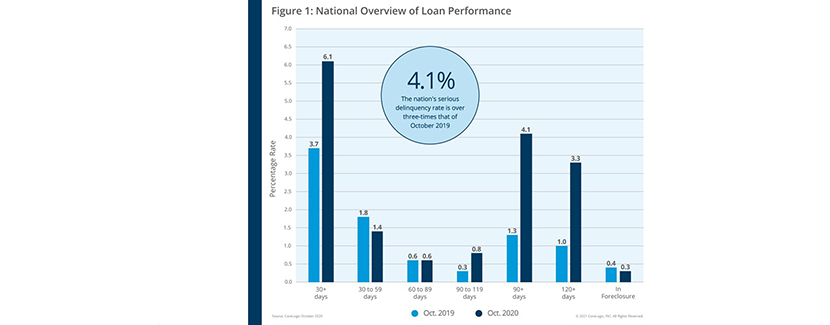

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

The company’s monthly Loan Performance Insights also reported serious delinquency more than three times that of a year ag, but down from the previous two months. Other findings:

· Early-Stage Delinquencies (30 – 59 days past due): 1.4%, down from 1.8% in a year ago.

· Adverse Delinquency (60 – 89 days past due): 0.6%, unchanged from 0.6% in a year ago.

· Serious Delinquency (90 days or more past due, including loans in foreclosure): 4.1%, up from 1.3% a year ago, but down slightly from 4.2% in September and 4.3% in August.

· Foreclosure Inventory Rate: 0.3%, down from 0.4% a year ago. The foreclosure rate has stayed at 0.3% for seven consecutive months, which was the lowest since at least January 1999.

· Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, up from 0.7% a year ago.

CoreLogic said job loss and increased closures of small businesses triggered higher delinquency rates during the pandemic. A record amount of home equity, and the CARES Act loan forbearance, have helped to keep borrowers out of foreclosure, leading to a decline in the foreclosure rate despite high delinquency rates.

“During early autumn, the improving economy enabled more families to remain current on their home loan,” said CoreLogic Chief Economist Frank Nothaft. “In September and October, 0.8% of current borrowers transitioned into 30-day delinquency. This is the same as the monthly average for the 12 months prior to the pandemic, and well below the record peak of 3.4% of borrowers transitioning into delinquency that we observed in April.”

“After a financially challenging year, the healthy housing market and new stimulus measures are helping borrowers get back on their feet,” said CoreLogic President and CEO Frank Martell. “Given these variables, we should begin to see a reduced flow of homes in delinquency in the coming months.”

The report said every state logged an annual increase in overall delinquency rates in October, with Hawaii (up 4.7 percentage points) and Nevada (up 4.6 percentage points) again topping the list for gains.

Similarly, nearly all U.S. metro areas logged an increase in overall delinquency rates in October. Lake Charles, La.—which was severely impacted by Hurricane Laura in August—saw the largest annual increase for the second consecutive month with 11 percentage points. Other metro areas with significant overall delinquency increases included Odessa, Texas (up 10.3 percentage points); Kahului, Hawaii (up 7.8 percentage points) and Midland, Texas (up 7.5 percentage points).