Report Warns 4.3 Million U.S. Homes at ‘Substantial’ Flood Risk

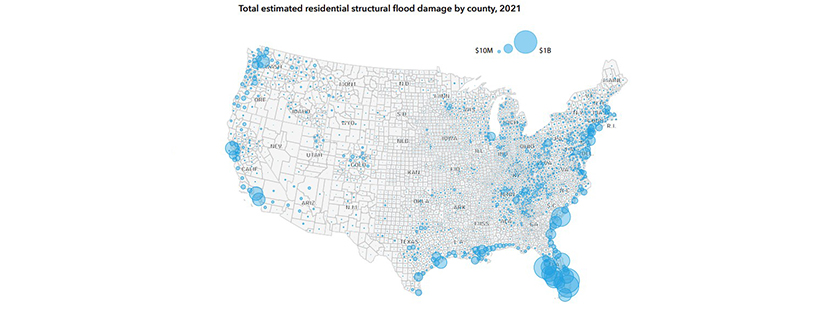

(Map courtesy First Street Foundation.)

New research from First Street Foundation, Brooklyn, N.Y., warns the financial impacts of flood risk carried by American homeowners, and how those impacts are growing as flood risks worsen due to a rapidly changing climate.

First Street Foundation found nearly 4.3 million residential homes (1-4 units) across the country with substantial flood risk that would result in financial loss. Furthermore, the research demonstrates that if all of these homes were to be insured against flood risk through the National Flood Insurance Program, the rates would need to increase 4.5 times to cover the risk today.

The Foundation’s analysis was conducted in part with home value data acquired from ComeHome by HouseCanary. The research allows First Street Foundation to calculate average annual loss statistics for each residential property in the contiguous United States, which is the dollar value of damage associated with flood risk each year.

The Foundation reported while the total expected annual loss for properties is $20 billion this year, it grows to nearly $32.2 billion a year in 30 years – an increase of 61% – due to the impact of a changing climate. These estimates suggest the NFIP, which has lost more than $36 billion since its inception, will face growing losses in the years ahead without reform.

“Quantifying flood risk in economic terms creates a new context for homeowners to understand their risk, and for buyers to consider when evaluating a property,” said Matthew Eby, Founder and Executive Director of First Street Foundation. “Flood risk brings with it real and potentially devastating financial impacts that aren’t being priced into the market.”

The report said for all properties with any flood risk, $20.3 billion in annualized expected economic damage in today’s environment. The heaviest concentration of those economic losses are centered in Florida and California. Florida alone accounts for nearly $8 billion in potential losses, while California contributes more than $1.7 billion. Other states significantly contributing to the potential loss totals are South Carolina ($1.2 billion), Texas ($1.2 billion) and Louisiana ($888 million).

When examining the average estimated annual loss for properties with any flood risk on a per-property basis, Delaware has the highest value at $21,361 per property at risk of economic loss in the model. South Carolina ($11,634), Florida ($7,481), Washington ($6,450) and California ($4,394) round out the top five. Of these five states, Delaware and South Carolina tend to have the combination of high probability flooding risk and

high property values in the areas that flood often, which together drive higher average economic loss estimates. Florida, in contrast, has much more risk across the entire state which affects both high- and low-value homes, leading to a lower relative estimated average annual loss.

The report also noted nine of the top 10 counties in terms of total estimated annual economic damage across the entire U.S. are in Florida. At the top of this list is Broward County, with an estimated annual loss of $1.3 billion, which accounts for roughly 16% of Florida’s overall economic risk. Pinellas County is next on the list with a $1 billion estimated annual loss, followed closely by Miami-Dade County ($1 billion). Charleston County, S.C. ($744 million), Charlotte County ($708 million), Lee County ($620 million), Brevard County ($512 million), Sarasota County ($485 million), Hillsborough County ($456 million) and Palm Beach County ($397 million.

The report noted the Federal Emergency Management Administration is working to better price flood risk at the individual property level to more accurately reflect the risk of today’s climate through its forthcoming “Risk Rating 2.0” initiative, which will set new premiums for properties both inside and outside of Special Flood Hazard Areas based on their individual flood risk.

The report said the 2.7 million properties at risk outside the SFHA would require a 5.2 times price increase to roughly $2,484 a year to cover their current risk. The 1.5 million properties within SFHAs, which are mandated to buy flood insurance if they hold a federally backed mortgage, would require an increase of 4.2 times, to $7,895 a year.

“If the necessary adjustments to premiums were put in place to accurately reflect property level risk, those homes which previously benefited most from group based subsidized rates would see a reduction in their underlying value,” said Jeremy Porter, Head of Research and Development at First Street Foundation.

The report can be accessed at https://assets.firststreet.org/uploads/2021/02/The_Cost_of_Climate_FSF20210219-1.pdf.