MBA: 2Q Commercial/Multifamily Mortgage Debt Rises

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

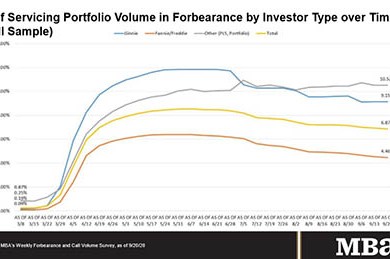

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

MBA Advocacy Spurs Crackdown on Deceptive VA Loan Marketing

The settlements signal a remarkable effort by the CFPB to hold lenders accountable for their dealings with the nation’s veterans—and the culmination of advocacy by the Mortgage Bankers Association to protect earned benefits for servicemembers, veterans and surviving spouses.

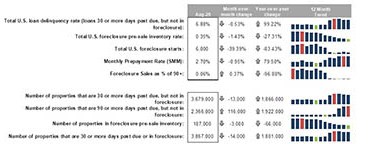

Black Knight First Look: Early-Stage Delinquencies Improve, Serious Past-Due Loans Rise

Black Knight, Jacksonville, Fla., issued its monthly First Look Mortgage Monitor, reporting the divergence between early-stage delinquencies and seriously past-due mortgages continues to widen as fewer delinquent loans cured to current status in August.

FHA: GSEs Complete 252,000 2Q Foreclosure Preventions

The Federal Housing Finance Agency said Fannie Mae and Freddid Mac completed 252,014 foreclosure prevention actions in the second quarter, bringing to 4.68 million the number of troubled homeowners who have been helped during conservatorships.