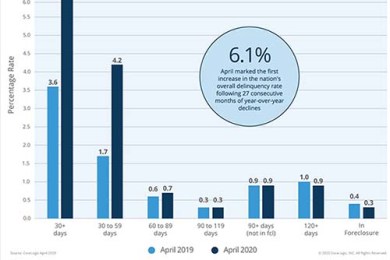

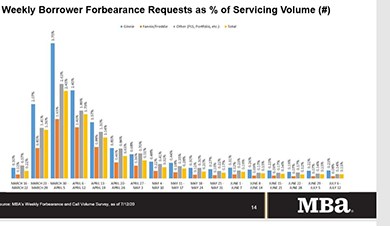

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

MBA Asks HUD to Withhold Publication of Final Disparate Impact Rule

The Mortgage Bankers Association asked HUD to withhold publication of its final disparate rule, citing “legitimate concerns” that the rule erodes protections needed to combat housing discrimination and systemic inequality.

MBA Urges House to Support FY2021 T-HUD Priorities

The Mortgage Bankers Association, in a July 14 letter to House leadership, urged the House to approve key industry-supported provisions for FHA in the federal government’s fiscal 2021 proposed budget.

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.

FHA Proposes Streamlined Single-Family Servicing Policies; CFPB Touts Benefits of Credit Builder Loans

The Federal Housing Administration last week published proposed revisions to its Single-Family servicing policies, designed to remove “unnecessary barriers” for homeowners seeking mortgage payment relief, achieve operational consistency with industry standard best practices and reduce burdens incurred by the industry when servicing an FHA-insured mortgage portfolio.

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.