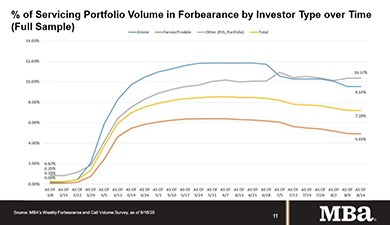

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

CFPB Extends Comment Period on ECOA/Reg B RFI to Dec. 1

Bowing to requests by the Mortgage Bankers Association and other industry trade groups, the Consumer Financial Protection Bureau on Aug. 19 said it will provide an additional 60 days for public comment on its Request for Information on expanding access to credit through Regulation B, which implements the Equal Credit Opportunity Act.

CFPB Proposes New Category of Qualified Mortgages

The Consumer Financial Protection Bureau on Aug. 18 issued a notice of proposed rulemaking to create a new category of seasoned qualified mortgages, called “Seasoned QMs,” to “encourage innovation and help ensure access to responsible, affordable in the mortgage credit market.”

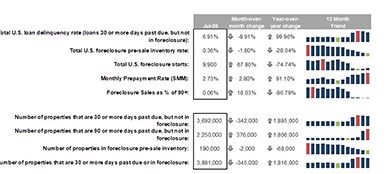

Black Knight: Mixed Results on Delinquencies; Monthly Prepayment Activity Hits 16-Year High

Black Knight, Jacksonville, Fla., said its “First Look” Mortgage Monitor showed while overall delinquencies continued to show improvement, serious delinquencies rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels.

ATTOM: Refis Make Up 2/3 of 2nd Quarter Loans, Highest Level in 7 Years

ATTOM Data Solutions, Irvine, Calif., released its second-quarter U.S. Residential Property Mortgage Origination Report, showing 1.69 million refinance mortgages secured by residential properties (1 to 4 units) originated, up nearly 50 percent from the prior quarter and more than 100 percent from a year ago, to the highest level in seven years.