‘Zombie’ Properties Fall Below 3%

ATTOM Data Solutions, Irvine, Calif., said 1.527 million U.S. single-family homes and condos were vacant in the fourth quarter, representing 1.5 percent of all U.S. homes.

The company’s fourth quarter Vacant Property and Zombie Foreclosure Report said 288,300 homes were in the process of foreclosure, with 8,535, or 2.96 percent, sitting empty as “zombie” foreclosures. The percentage of zombie properties is down from 3.2 percent in the third quarter and 4.7 percent in Q3 2016, the last comparative foreclosure vacancy report.

“The fourth quarter of 2019 was a repeat of the third quarter when it came to properties abandoned by owners facing foreclosure: the scourge continued to fade,” said Todd Teta, chief product officer with ATTOM Data Solutions. “One of the most visible signs of the housing market crash during the Great Recession keeps receding into the past. While pockets of zombie foreclosures remain, neighborhoods throughout the country are confronting fewer and fewer of the empty, decaying properties that were symbolic of the fallout from the housing market crash during the recession.”

Key report findings:

–8,535 properties facing possible foreclosure were vacated by their owners nationwide in the fourth quarter. Washington, D.C. continued to have the highest percentage of zombie foreclosures (10.5 percent).

–States where the zombie foreclosure rates were above the national rate of 2.9 percent included Kansas (7.9 percent), Oregon (7.9 percent), Montana (7.4 percent); Maine (6.7 percent) and New Mexico (5.8 percent). The lowest rates–all less than 1.2 percent–were in North Dakota, Arkansas, Idaho, Colorado and Delaware.

–New York had the highest actual number of zombie properties (2,266), followed by Florida (1,461), Illinois (892), Ohio (823) and New Jersey (398). But those numbers were all lower than in the third quarter.

–Among metropolitan areas with at least 100,000 residential properties, Peoria, Ill., continued to have the highest percent of vacant foreclosures (zombies) at 13.5 percent, followed by Wichita, Kan. (10.2 percent), Lexington, Ky., (9.8 percent); Syracuse, N.Y. (9.3 percent) and Honolulu (8.6 percent).

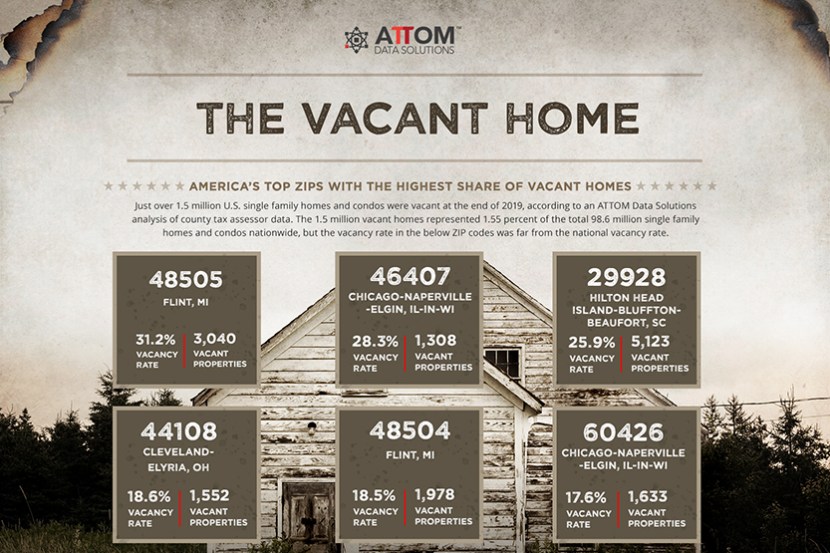

–Among zip codes with a population of 10,000 or more and least 1,000 vacant properties, the highest rates of zombie foreclosure properties remained concentrated in the Midwest. Zip codes with the top percentages included 48505 and 48504 zip codes in the Flint, Mich., metro area; 46407 and 60426 zip codes in the Chicago metro area; 29928 zip code in the Hilton Head, S.C. metro area; and 46016 zip code in the Indianapolis metro area.

–Top zombie foreclosure rates in counties with at least 500 properties in foreclosure included Peoria County, Ill. (17.2 percent); Baltimore City/County, Md. (11.5 percent); Broome County, N.Y. (10.3 percent); Onondaga County, N.Y. (9.7 percent) and Cuyahoga County, Ohio (9.4 percent).

–Highest levels of vacant investor-owned homes were in Indiana (8.7 percent), Kansas (6.6 percent), Minnesota (6.0 percent), Ohio (5.9 percent) and Rhode Island (5.9 percent).

–Highest overall vacancy rates for all residential properties were in Tennessee (2.7 percent); Kansas (2.7 percent); Indiana (2.6 percent); Oklahoma (2.5 percent) and Mississippi (2.5 percent). The lowest were in New Hampshire (0.4 percent); Vermont (0.4 percent); Delaware (0.5 percent); Idaho (0.6 percent) and North Dakota (0.7 percent).