MBA CEO to Senate Committee: GSE Reform Should Proceed ‘Without Delay’

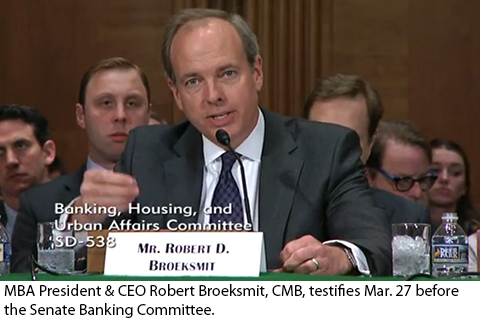

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in testimony Mar. 27 before the Senate Banking Committee, said Congress should move forward with comprehensive housing reform legislation without delay.

“The housing finance system requires structural reforms that will ensure a stable, liquid secondary market to support a vibrant, diverse primary market, and comprehensive legislation is essential for such reforms,” Broeksmit said.

Also on Wednesday, President Trump signed an executive memorandum designed to initiate housing finance system reform. Broeksmit released a statement Thursday commending the administration “for fashioning a memorandum designed to promote competition in the real estate finance markets and protect taxpayers.”

Banking Committee Chairman Mike Crapo, R-Idaho, invited Broeksmit to appear before the committee several weeks ago as part of a two-part hearing this week designed to bring housing finance reform legislation to the forefront in the 116th Congress.

Banking Committee Chairman Mike Crapo, R-Idaho, invited Broeksmit to appear before the committee several weeks ago as part of a two-part hearing this week designed to bring housing finance reform legislation to the forefront in the 116th Congress.

In February, Crapo released an outline of a housing reform bill (https://www.banking.senate.gov/imo/media/doc/Housing%20Reform%20Outline.pdf), which would create a “permanent, sustainable new housing finance system” that includes the following elements:

–Reduces the systemic, too-big-to-fail risk posed by the current duopoly of mortgage guarantors;

–Preserves existing infrastructure in the housing finance system that works well, while significantly increasing the role of private risk-bearing capital;

–Establishes several new layers of protection between mortgage credit risk and taxpayers;

–Ensures a level playing field for originators of all sizes and types, while also locking in uniform, responsible underwriting standards; and

–Promotes broad accessibility to mortgage credit, including in underserved markets.

The framework includes substantial alignment with the MBA 2017 GSE reform proposal (https://www.mba.org/issues/gse-reform), which calls for a system in which well-capitalized, private guarantors issue and provide credit enhancement on securities that receive a full-faith-and-credit federal government guarantee through Ginnie Mae. It would also split the multifamily operations at the GSEs into separate guarantors.

Broeksmit praised Crapo for the framework and urged him and the Banking Committee to move forward.

“The 2008 financial crisis exposed fundamental problems in the GSEs’ business models, as well as weaknesses in the regulatory framework,” Broeksmit said. “Ten years later, we have still not determined how or if the GSEs will be permanently reformed. Only by enacting comprehensive legislative reform can we provide the confidence necessary for a stable, sustainable and inclusive mortgage market. Reform should proceed without delay.”

Broeksmit noted the Crapo outline recognizes the need for competition in the secondary market with privately owned, well-regulated entities standing before a full faith and credit federal guarantee. “Such a guarantee is a critical determinant of investor demand, and should apply to securities in both the single-family and multifamily markets,” he said.

Broeksmit also noted the Crapo proposal provides that the explicit guarantee be provided and managed by Ginnie Mae. “This structure is viable, as Ginnie Mae is designed to perform this function and has a proven history of ensuring payments on government-guaranteed securities,” he said. “The use of a Ginnie Mae guaranty, however, should not be confused with the use of the Ginnie Mae securitization infrastructure and processes–that is, a system in which lenders issue securities rather than deliver loans to guarantors.”

Broeksmit said based on extensive feedback from its members, MBA believes a system structured around guarantors minimizes transition risks and ensures equal access to the secondary market for a diverse set of lenders–consistent with the Crapo proposal. “Market access by lenders of all types and sizes provides tangible benefits for homebuyers through broader competition and availability of credit in all markets at all times,” he said.

In the multifamily market, Broeksmit said reform efforts should preserve those elements of the GSEs’ multifamily businesses that have been successful. He said any capital framework under which guarantors operate should seek to produce comparable treatment of varying executions and Credit Risk Transfer structures.

And Broeksmit reinforced MBA’s provision that any reform proposal should have an affordable housing component. “One of the greatest challenges to enacting comprehensive reform has been conflicting views on how best to ensure widespread availability of affordable housing, particularly to low- to moderate-income households,” he said. “Two factors that affect affordability in many areas of the country are low inventory and home prices that are rising faster than wages. In order to best promote sustainable housing for underserved segments of the population, any future system should generate the necessary funding to address these access and affordability challenges. The outline could be enhanced with quantitative and qualitative evaluations of the secondary market guarantors.”

Another benefit of enacting legislation, Broeksmit said, is cementing regulatory reforms that have already taken place over the past decade. He noted Crapo’s outline seeks to accomplish this in a number of areas, such as a prohibition on volume-based pricing discounts, ongoing use of credit risk transfers and significantly smaller investment portfolios.

“If the GSEs were to exit conservatorship without corresponding legislation, these reforms could be weakened or even reversed,” Broeksmit said.

Broeksmit emphasized MBA’s work with consumer advocates and other market participants has revealed a growing consensus on the foundation of the future state of housing finance in America.

“Access to affordable, sustainable housing is a necessity for all Americans, and as such, it requires a system of financing that is robust in all parts of the country, through all parts of the credit cycle, supporting both home ownership and rental housing,” Broeksmit said. “Legislative reform of the GSEs offers the best path to reach this desired end state.”

Broeksmit’s full testimony can be accessed at https://www.banking.senate.gov/imo/media/doc/Broeksmit%20Testimony%203-27-19.pdf.