Risk Management and Fraud: Executive Perspectives

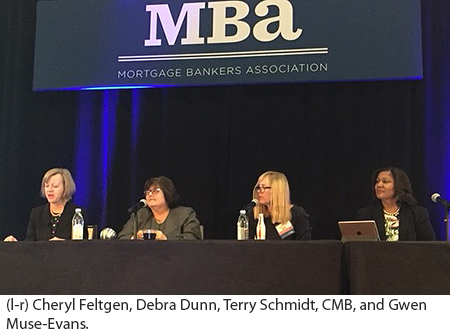

LOS ANGELES–Three risk management executives: Debra Dunn, Chief Operating Officer with SWBC Mortgage, San Antonio, Texas; Gwen Muse-Evans, President and CEO of GME Enterprises, Bethesda, Md.; and Terry L. Schmidt, CMB, Executive Vice President and CFO of Guild Mortgage Co., San Diego; offered their perspectives on risk management and fraud issueshere at the recent Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum.

“Looking at risk and long-term sustainability, we’re focusing on what’s best for the customer-making decisions in light of that,” Dunn said. “As we evaluate products, programs and technology, we want to make sure the choices we make have a reasonable ROI and set that parameter ahead of time, instead of finding out a year later that it isn’t working, or to figure out a way to further leverage it if it is working.”

“Looking at risk and long-term sustainability, we’re focusing on what’s best for the customer-making decisions in light of that,” Dunn said. “As we evaluate products, programs and technology, we want to make sure the choices we make have a reasonable ROI and set that parameter ahead of time, instead of finding out a year later that it isn’t working, or to figure out a way to further leverage it if it is working.”

The industry has made a lot of bad decisions in the past, Dunn added. “We can’t think in the moment; we have to take a breath and figure out what’s best,” she said.

Schmidt said Guild’s focus is on metrics and efficiency. “It’s critical to drill down to the loan level,” she said. “We need to know who’s doing well and who needs more training.”

Guild is also focusing on “leakage”–business losses. “We have to make changes to get into a profitable position,” Schmidt said. “We’re in a good spot right now, but we need to be better, and we can be better.”

“Many mortgage bankers are not profitable right now,” said Muse-Evans. “But they still have to invest in technology. We see a correlation between companies’ performance and how they use technology. We are also looking at companies that are focused on culture and how it promotes quality.”

Muse-Evans noted many companies are looking at new ways to regain market share. “We’re seeing more companies that are looking at new channels to do business, rather than hunkering down,” she said. “That’s good, and there’s plenty of opportunity, but it has to be done with prudent credit standards.”

Dunn said the biggest risk facing the industry is cybersecurity risk. “We’re seeing serious regulation at the state level, but beyond that is reputational risk,” she said. “Whenever there’s a breach–even if it’s a small one–the time spent evaluating it and assessing it and determining root costs and putting prevention measures in place is the overriding issue for so many of us. It’s the most uncontrollable aspect, even when we have things in place to control it, we can’t control it and it’s always hanging over our head.”

Schmidt agreed. “There are so many parts to the transactions,” she said. “You can control your part of the transaction, but the realtor and the appraiser do not have the same controls in place.”

GSE reform is a hot topic for Muse-Evans, who spent more than 13 years at Fannie Mae. “I’m ready for GSE reform,” she said. “Fannie Mae and Freddie Mac have done a good job through the conservatorship in staying in touch with their customers and bringing value to their clients and the market. As the Administration turns the corner to look at GSE reform, the challenge will be not to disrupt what is working. If you look at the role of the GSEs and the perception that they controlled and manipulated the market, we know that GSE reform has to address many issues, including liquidity and risk. The market is not engaging the way it used to. It’s going to be difficult to tackle GSE reform any time soon.”

Having said that, Muse-Evans noted both the CEOs of Fannie Mae and Freddie Mac (Tim Mayopoulos and Donald Layton, respectively), as well as Federal Housing Finance Agency Director Mel Watt, are all leaving. “This provides an opportunity, but I’m concerned that the market is not there yet for real reform,” she said.

“The status quo cannot last forever,” Dunn said. “It really needs to be something that all of us are involved in so we can have a voice; so that we can be prepared. Things have a way in Washington of going on and on forever and then suddenly it gets done in a day. We have to be engaged.”

The housing market is in flux, Muse-Evans noted. “We’re seeing low housing inventories; however, some areas on the West Coast have very high demand,” she said. “It’s a concern and it’s something we must continue to watch. My biggest concern is with fraud. I’m worried that we are going to see a rise in fraud for housing.”

Additionally, with many non-traditional income sources emerging, Muse-Evans said she expected fraud to increase, particularly in overheated markets.

Dunn agreed. “We’re also seeing this happen in some non-traditional areas, such as Dallas and Fort Worth,” she said. “It pays for us to pay attention, and we don’t want to find out too late that our processes are inadequate.”

The fraud risk increases for credit expansion as well. “Mark Twain said ‘History doesn’t repeat itself, but it does rhyme,'” Dunn said. “As folks find themselves talking about credit guidelines that they haven’t thought about for some time, one of the things we think about is when we know we’ve gone too far. We talk about our risk tolerance on a regular basis, and we evaluate against the line we’ve drawn. We need to make sure that bright line is there. When the hair starts raising on the back of our neck, we need to speak out and voice our concerns. It’s not enough to say, ‘that’s not a good idea.’ We need to be able to back it up with data and technology.”

“One of the things we have to be, as risk people, is the person who stands in front of the train,” Muse-Evans said. “We have to be able to test, with limits, even as we look at new ways to gain share and non-traditional borrowers. We should be going into non-traditional markets, but with limits.”

This is especially important now, when the economy is doing well. “I think there will be a recession, but it shouldn’t affect the industry as bad as the Great Recession,” Schmidt said. “We are so much better with credit quality, and the housing stock is not as big as it was back then. The only negative I see is that consumers aren’t saving enough. If sales prices start stabilizing, we can see more people who are currently sitting on the sidelines get into the market.”

Technology will continue to be a game-changer, Dunn said. “There are many models that will work,” she said, “but we have to be nimble and we have to be adaptable in how we do business.

All three executives said they’ve learned important lessons from risk management. “It’s not what you make; it’s what you keep that matters,” Dunn said. “In risk management, there are a lot of things you can worry about. You have to be a warrior, not a worrier–understanding what you’re up against and planning a strategy.”

“BE prepared for change, because we know that change is every day in this industry,” Schmidt said. “Stay involved and network and be abreast of what is going on. You ca have the best-laid plans, but you have to follow the framework.”

“Risk management needs to be tied to the strategy of the organization,” Muse-Evans said. “They [management] have to be tied to growth. And to do so you have to be creative; you have to be on top of trends, so we can make changes to the credit box.”