MBA Calls for Improved Policing of VA Loan ‘Churning’

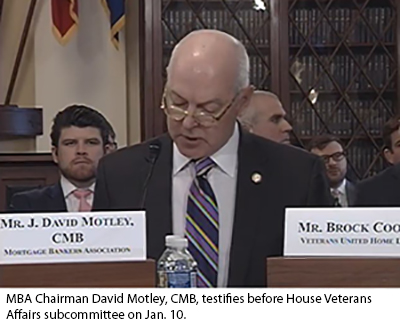

Mortgage Bankers Association Chairman David Motley, CMB, testifying Jan. 10 before a House subcommittee, said lenders who engage in serial refinancing (“churning”) of Veterans Affairs loans run counter to sound lending practices and expressed support for measures that result in stronger policing of such practices.

Appearing before the House Veterans Affairs subcommittee on Economic Opportunity, Motley, president of Colonial Savings FA, Fort Worth, Texas, said lenders that mislead veterans through churning–a practice by which lenders encourage veterans to refinance loans, sometimes repeatedly and at higher rates, in such a way that it strips equity–should face consequences for their practices.

Appearing before the House Veterans Affairs subcommittee on Economic Opportunity, Motley, president of Colonial Savings FA, Fort Worth, Texas, said lenders that mislead veterans through churning–a practice by which lenders encourage veterans to refinance loans, sometimes repeatedly and at higher rates, in such a way that it strips equity–should face consequences for their practices.

“MBA fully supports supervisory efforts to improve the policing of the market, as well as new rules to remove the ability or incentive for any lenders to engage in churning,” Motley told subcommittee members.

Churning involving VA loans caught the attention of regulators and Congress late last year. In December, Ginnie Mae, which securitizes VA loans, imposed a moratorium on how often lenders are allowed to place a mortgage to a particular borrower into a Ginnie Mae-backed bond. It also said it would improve its tracking of the frequency of lender refinances and the rates they charge, threatening penalties for rates more than 1.5 percent above market rates.

In his testimony, Motley said Colonial Savings, founded by “Jimmy” DuBose, a veteran himself, has originated loans for veterans for more than 65 years and currently services more than 6,000 loans for VA borrowers. He noted while those borrowers seeking to refinance their VA loans may apply and be evaluated through their lender’s full underwriting process, the VA Interest Rate Reduction Refinance Loan allows for a streamlined refinance process that is often faster and entails lower costs.

“Recently, a small number of lenders have undertaken aggressive–and potentially misleading–advertising campaigns to generate increased IRRRL volumes and fees,” Motley said. “In some cases, this advertising targets VA borrowers who have just recently engaged in an IRRRL, convincing them to refinance yet again to lower their interest rate by a modest amount while adding even more fees to the principal balance on the loan. Such serial refinancing, or churning, strips borrower equity and often further extends the time period it takes for the costs to be recouped through lower payments. Some lenders also use the IRRRL to lower the rate, but only by moving the veteran from a 30-year fixed rate to a three-year adjustable-rate mortgage.”

Motley cautioned many borrowers may not fully comprehend the net economic impact of their decision to refinance, leaving them vulnerable to situations in which they add substantial amounts to their overall loan balance while achieving only small reductions in their monthly payments.

“This is not what the program was intended to do, and these practices should be put to an end,” Motley said. “Aggressive use of IRRRLs by some lenders also threatens to weaken investor demand for Ginnie Mae securities that are partially backed by VA loans. This outcome increases costs and negatively impacts access to credit for a wide range of borrowers.”

Motley noted IRRRL churning is not a widespread problem among the mortgage lender community, “but rather an activity that is confined to a small subset of lenders.”

While Ginnie Mae has taken “important steps” to both study and address this issue, the problem of loan churning cannot be solved by Ginnie Mae alone. “Fortunately, many practical options fall within the existing authority of VA to implement,” he said.

For example, instituting a maximum recoupment period would inhibit lenders from charging substantial fees in exchange for minor reductions in mortgage interest rates. Similarly, requiring a net tangible benefit test, which is already required for FHA streamlined refinances, could more effectively ensure that the terms of the refinance produce real benefits for borrowers. Limits on the amounts that can be added to the principal balance would reduce equity stripping. And finally, targeted consumer financial education about churning can better inform borrowers about the potential for abuse.

“It’s important to focus on options that target churning while not impeding the ability of service members and veterans to obtain a beneficial refinancing,” Motley said. “We recognize that the VA program is a unique loan program–an entitlement program for veterans who have served our country. As such, while we support quick action to limit abuses, it needs to be done thoughtfully to ensure that legitimate low cost refinancing options for veterans are retained.”