MBA Chart of the Week: Homeowners’ Equity and Home Equity Loans

Source: Federal Reserve.

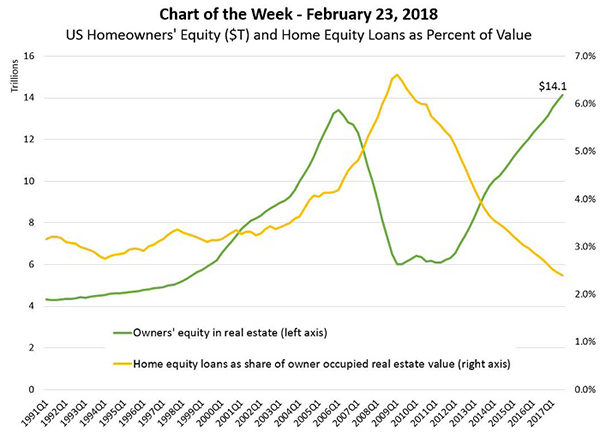

As house prices climb, the amount of American homeowner equity continues to grow. As of third quarter 2017, the Federal Reserve estimates owners’ equity–that is, aggregate home value less outstanding mortgage debt–is $14.1 trillion.

Home equity has surpassed the previous peak of $13.4 trillion from first quarter 2006 during the past year, recovering from the great price correction that more than halved home equity positions. Home equity holdings were 40 percent higher than the aggregate value of household and non-profit checking and savings accounts in the third quarter, emphasizing its importance on the household balance sheet.

At the same time, the percentage of home value accessed or borrowed through home equity lines of credit or loans has declined steadily since 2008, when falling house prices caused the share to rise to an unprecedented level. It now stands at just 2.4 percent of home value compared to pre-boom levels of 3-3.5 percent.

As interest rates slowly rise, home equity loans may become increasingly attractive to potential borrowers who seek to preserve the low rate of interest in their current mortgage. Despite the fact that the recent Tax Cuts and Job Act eliminated the deductibility of interest for these loans through 2026, the Internal Revenue Serivce issued IR-2018-32 last week (https://www.irs.gov/newsroom/interest-on-home-equity-loans-often-still-deductible-under-new-law), stating that the interest on home equity loans and HELOCs for buying, building or substantially improving the home securing the loan will be deductible.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan is associate vice president of industry surveys and forecasting with MBA; he can be reached at jkan@mba.org).