MBA Preliminary Analysis of 2016 HMDA Data

The 2016 Home Mortgage Disclosure Act data were released late last week, along with a separate Federal Reserve analysis of the data. Here are some initial highlights:

Reporting Institutions

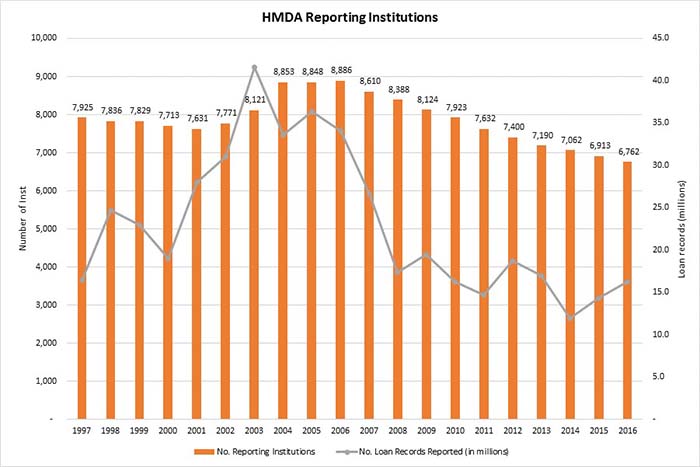

In the newly released HMDA data for mortgage activity during calendar year 2016, there were 6,762 reporting institutions, a 2 percent decrease from 6,913 institutions in 2015. This was significantly lower than the peak of 8,886 institutions in the industry during 2006 and relative to that year, the number of HMDA reporters was down by 24 percent.

HMDA reporting institutions in 2016 handled 16.3 million loan records, which was a 14 percent increase from 14.3 million loan records in 2015, an indication of further consolidation in the industry. The number of loan records in 2016 was still well down from its 2003 peak of 41.6 million loans.

Originator Composition

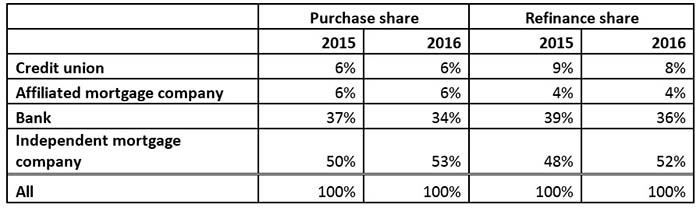

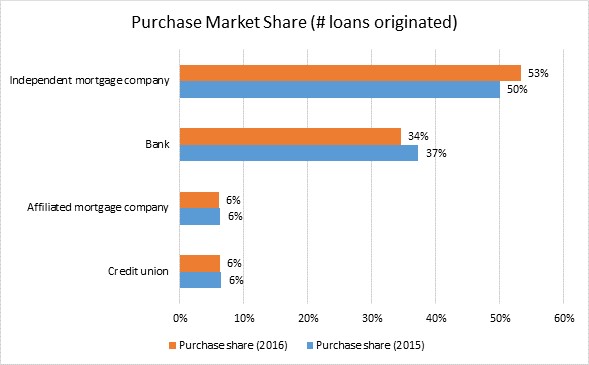

The mortgage industry continues to shift in terms of its composition of originators. The Federal Reserve reported 53 percent of first lien, owner-occupied home purchase loans were originated by independent mortgage companies in 2016, compared to a 50 percent market share in 2015. Banks continued to shrink in market share, originating 34 percent of purchase originations in 2016 compared to 37 percent in 2015.

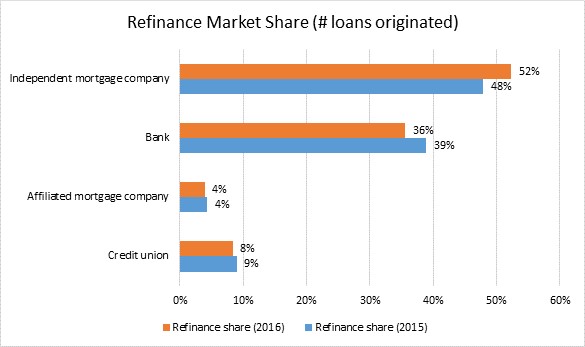

On the refinance side, independents saw an increase in share to 52 percent of originations, a sizable increase from 48 percent in 2015. Banks’ share of refinance originations decreased to 36 percent from 39 percent in 2015. Note that these percentages do not add to 100 percent because of credit unions and affiliates.

HMDA Coverage

HMDA covers most of the mortgage market but not all of it. Using the data from lenders covered under HMDA, first lien, 1-4 unit, owner occupied origination volume for 2016 was $1.95 trillion, a 19 percent increase from $1.64 trillion in 2015.

Both home purchase and refinance originations increased in 2016. Purchase originations saw a 14 percent increase, to $1 trillion in 2016 from $876 billion in 2015. Refinance volume increased 24 percent to $949 billion in 2016 from $768 billion in 2015, as 30 year fixed rates stayed below the 4 percent mark for most of 2016 (9 out of 12 months), averaging 17 basis points lower than in 2015.

Stay tuned for additional reports and analysis based on the 2016 HMDA data from MBA Research, including our Originations DataBook: https://www.mba.org/store/products/market-and-research-data/mba-2017-originations-databook-(with-2016-data).

Sources

–“Residential Mortgage Lending in 2016: Evidence from the Home Mortgage Disclosure Act Data” Federal Reserve Bulletin, https://www.federalreserve.gov/publications/files/2016_HMDA.pdf.

–“Residential Mortgage Lending from 2004 to 2015: Evidence from the Home Mortgage Disclosure Act Data” Federal Reserve Bulletin, https://www.federalreserve.gov/pubs/bulletin/2016/pdf/2015_HMDA.pdf.

(Joel Kan is associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).