Delinquency, Foreclosure Rates at Near 10-Year Lows

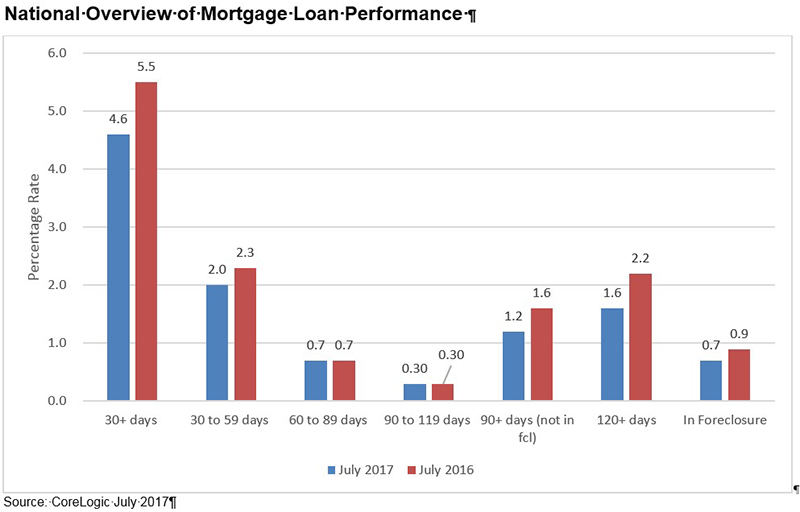

CoreLogic, Irvine, Calif., reported 4.6 percent of U.S. mortgages in some stage of delinquency in July, down by nearly 1 percent from a year ago.

The company’s monthly Loan Performance Insights Report said the national foreclosure inventory rate fell to 0.7 percent in July, down from 0.9 percent a year ago and the lowest rate since July 2007.

CoreLogic said the rate for early-stage delinquencies (30-59 days past due) fell to 2 percent in July, down from 2.3 percent a year ago. The share of mortgages 60-89 days past due in July held steady at 0.7 percent from a year ago. The serious delinquency rate (90 days or more past due) declined to 1.9 percent in July from 2.5 percent a year ago and remains near the 10-year low of 1.7 percent reached in July 2007. Alaska was the only state to experience a year-over-year increase in its serious delinquency rate.

CoreLogic said the rate for early-stage delinquencies (30-59 days past due) fell to 2 percent in July, down from 2.3 percent a year ago. The share of mortgages 60-89 days past due in July held steady at 0.7 percent from a year ago. The serious delinquency rate (90 days or more past due) declined to 1.9 percent in July from 2.5 percent a year ago and remains near the 10-year low of 1.7 percent reached in July 2007. Alaska was the only state to experience a year-over-year increase in its serious delinquency rate.

“Even though delinquency rates are lower in most markets compared with a year ago, there are some worrying trends,” said Frank Martell, president and CEO of CoreLogic. “For example, markets affected by the decline in oil production or anemic job creation have seen an increase in defaults. We see this in markets such as Anchorage, Baton Rouge and Lafayette, La., where the serious delinquency rate rose over the last year.”

The report said the share of mortgages that transitioned from current to 30-days past due was 0.9 percent in July, down from 1.1 percent a year ago. By comparison, in January 2007 just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent and it peaked in November 2008 at 2 percent.

Nationally, delinquency rates ranked highest in Mississippi (8.4 percent), Louisiana (7.8 percent), New Jersey (7.1 percent), Alabama (6.4 percent) and West Virginia (6.2 percent). Best-performing states were North Dakota (2.1 percent), Colorado (2.2 percent), Montana and Oregon (2.6 percent) and South Dakota and Washington (2.7 percent).

Foreclosure rates ranked highest in Hawaii and Maine (1.4 percent), followed by the District of Columbia (1.3 percent) and Florida and New Mexico (1.2 percent). Arizona, Colorado, Michigan, Minnesota and Utah shared the lowest foreclosure rate in July (0.2 percent).