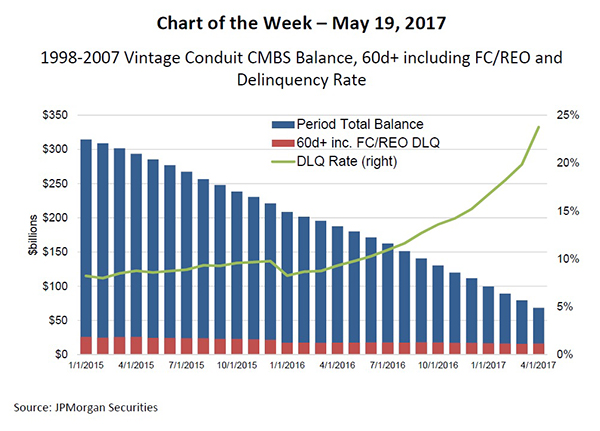

MBA Chart of the Week: 1998-2007 Vintage Conduit CMBS Balance, 60d+ including FC/REO and Delinquency Rate

Source: JPMorgan Securities

While most commercial and multifamily mortgage delinquency rates have been hovering at or near all-time lows, the same cannot be said for commercial mortgage backed securities.

According to data from Wells Fargo Securities, in 2016 the 60+ day delinquency rate for CMBS loans rose from 3.6 percent in March to 3.66 percent in June to 3.94 percent in September and 4.25 percent in December. At the end of the first quarter this year, the rate stood at 4.09 percent.

But don’t blame the recent rise in the delinquency rate on loans from 2007 that can’t refinance. Instead, blame it on loans from 2007 that CAN refinance. Based on data from JP Morgan Securities, since January 2015 the balance of CMBS 1.0 loans (those originated between 1998 and 2007) that are delinquent has dropped by 37 percent (from $26 billion to $16 billion). But over the same period, the overall outstanding balance of loans from that period has dropped by 78 percent (from $314 billion to $68 billion).

As loans from CMBS 1.0 successfully pay off, and the denominator shrinks, the slower decline in the balance of loans that are delinquent or in foreclosure (the numerator) pushes the rate higher. In this case, the rising CMBS delinquency rate may actually be a sign of success.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)