MBA Chart of the Week: Unpaid Balances of Non-Bank Commercial/Multifamily Mortgages

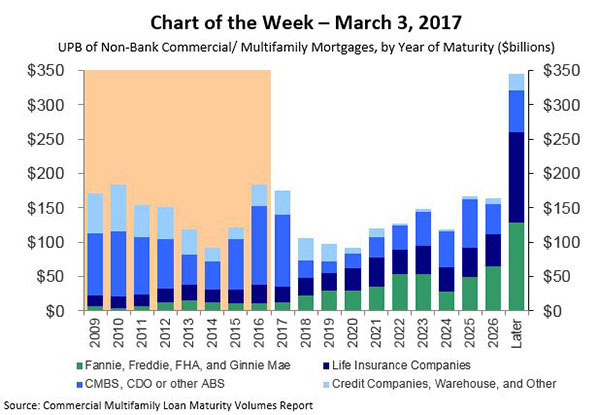

This year marks the end of the so-called “wall” of commercial and multifamily mortgage maturities stemming from 10-year loans made in 2006 and 2007.

As those loans have paid off and paid down, we’ve seen the amount left getting smaller, to the point that we have less in maturities this year than we did in either 2016 or 2010.

Ten percent, or $175.9 billion, of $1.7 trillion in outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2017, a 4 percent decrease from $183.3 billion that matured in 2016.

Just $12.1 billion of the outstanding balance of multifamily and health care mortgages held or guaranteed by Fannie Mae, Freddie Mac, FHA and Ginnie Mae will mature in 2017 (2 percent of the group balance). Life insurance companies will see $23.1 billion (5 percent) of their outstanding mortgage balances mature in 2017. Among loans held in commercial mortgage-backed securities, $104.4 billion (20 percent) will come due in 2017. Among commercial mortgages held by credit companies and other investors, $36.3 billion (22 percent) will mature in 2017.

Dollar figures reported are the unpaid principal balances as of December 31. Because most loans pay down principal, the balances at the time of maturity will generally be lower than those reported here.

More information about the MBA Commercial/Multifamily Loan Maturity Volumes report can be found at https://www.mba.org/news-research-and-resources/research-and-economics/commercial/multifamily-research/commercial/multifamily-loan-maturity-volumes?utm_source=Informz&utm_medium=Email&utm_campaign=mba.org&_zs=iS2FG1&_zl=5drc3.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)