MBA Chart of the Week: Servicing Costs Per Loan (Single-Family)–Performing v. Non-Performing

Source: MBA Servicing Operations Study

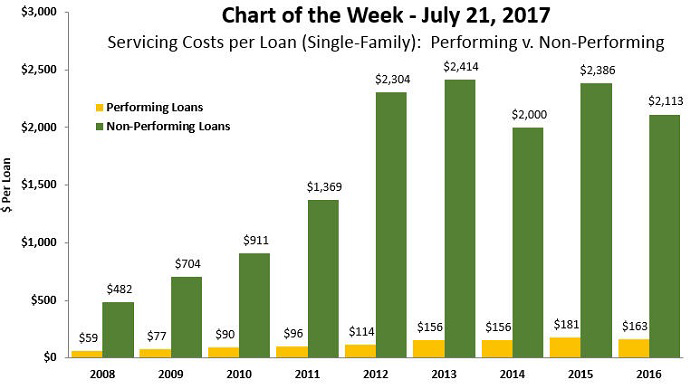

Servicing costs for performing loans dropped in 2016 for the first time since the beginning of the recession in 2008, according to the latest MBA Servicing Operations Study.

The average cost to service a performing loan was $163 in 2016, down from the study-high $181 per loan in 2015. Lower corporate overhead costs were the major contributing factor.

Costs associated with servicing performing loans include the base direct costs to service any loan, regardless of default status: call center, technology, escrow, cashiering, quality assurance, investor reporting and executive management, among others including corporate overhead.

Servicing costs for non-performing loans also dropped. The average cost of servicing a non-performing loan was $2,113 in 2016, down from $2,386 per loan in 2015. Non-performing loans include loans 30 or more days delinquent and loans in foreclosure or in REO status prior to investor conveyance. The drop for non-performing loans can be largely attributed to the decline in seriously delinquent loans (loans 90 days or more delinquent or in foreclosure). Seriously delinquent loans demand more specialized and time-intensive servicing resources, which increases costs.

Costs of servicing non-performing loans include the same base direct costs and corporate overhead as for performing loans, plus the following additional costs: collections, loss mitigation, bankruptcy, foreclosure and post-sale, unreimbursed foreclosure and real estate owned (REO) losses and other default-specific costs.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org.)