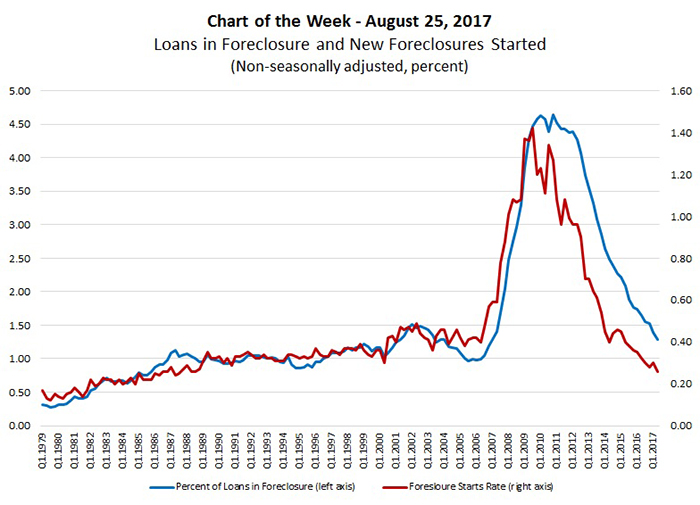

MBA Chart of the Week: Loans in Foreclosure and New Foreclosures Started

Source: MBA National Delinquency Survey

The Mortgage Bankers Association’s most recent National Delinquency Survey results show continuing resolution of distressed loans and fewer foreclosure starts have helped to reduce the number of loans in the foreclosure process to its lowest level since first quarter 2007.

The percentage of loans in the foreclosure process at the end of the second quarter was 1.29 percent, down 10 basis points from the previous quarter and 35 basis points lower than one year ago. The percentage of loans on which foreclosure actions were started during the second quarter was 0.26 percent, a decrease of four basis points from the previous quarter and six basis points lower than one year ago. The foreclosure starts rate was at its lowest level since 1988.

The employment outlook continues to support strong loan performance. Monthly job growth topped 200,000 jobs in July for the fifth time in the first seven months of the year. Possible factors that could influence a directional change include rising loan-to-value and debt-to-income ratios for certain product types, as affordability is stretched by tight inventory and rising home prices and normal loan aging.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)