MBA Chart of the Week: Agency Multifamily MBS and Total Private-Label CMBS Outstanding

Source: Morgan Stanley Research

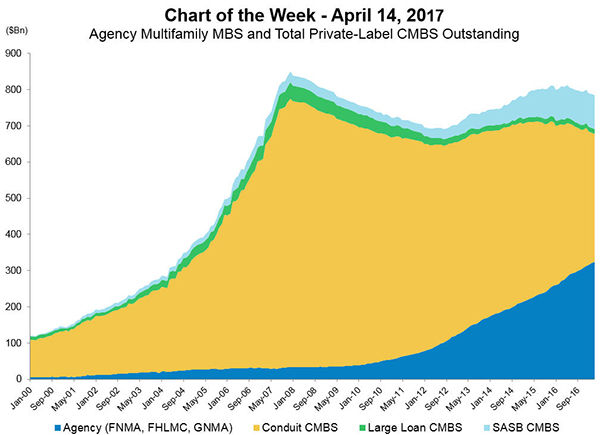

While volume has held relatively steady in recent years, the composition of securitized commercial and multifamily mortgage debt has changed dramatically.

Based on data from Morgan Stanley Research, the outstanding balance of private-label conduit commercial mortgage-backed securities declined by $80 billion between March 2016 and March 2017. During the same period, the balance of agency (Fannie Mae, Freddie Mac and Ginnie Mae) multifamily and health care securities increased by $53 billion. Large loan CMBS declined by $1 billion and single-asset single-borrower CMBS increased by $3 billion.

Since the recession, multifamily has been the strongest property type in terms of fundamentals, property values and mortgage lending. In 2016, 44 percent of commercial and multifamily mortgage bankers originations were backed by multifamily properties–tied with 2009 for the highest share since the MBA series began in 2005. The GSEs have been a major part of this growth.

On the other side, since 2008 the CMBS market has seen more in loans paying-down and paying-off than in new loans being originated, bringing the balance of private label conduit CMBS outstanding to half of its peak level.

Looking ahead, Agency multifamily MBS issuance shows no signs of slowing, and 2018 should bring greater stability to the private label CMBS market.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)