The Wall Street Journal, April 2, 2025More than 9 million student-loan borrowers could see a decline in their credit scores in the first half of the year, according to the …

Category: Top National News

FHA Issues QC Waiver for Some Wildfire-Related Defaults

National Mortgage News, April 2, 2025-Spencer LeeThe Federal Housing Administration issued a waiver on quality-control reviews for some newly distressed mortgages in Southern California, as homeowners continue to recover from …

OCC to Explore Alternative Credit Metrics

National Mortgage News, March 24, 2025-Ebrima Santos SannehActing Comptroller of the Currency Rodney Hood on Monday said his agency would explore potential ways banks can use financial technology, instead of …

Rocket to Buy Mr. Cooper Group in $9.4 Billion Mortgage-Industry Deal

The Wall Street Journal, March 31, 2025-Nicole Friedman and Dean SealMortgage giant Rocket is making good on its goal of becoming a one-stop shop for homeowners with its $9.4 billion …

Senior-Held Home Equity Falls in Q4 2024

HousingWire, March 31, 2025-Chris ClowFollowing a rise to an all-time high in the second quarter, senior-held home equity saw a modest decline in the third quarter and endured a more …

Core Inflation in February Hits 2.8%, Higher Than Expected; Spending Increases 0.4%

CNBC, March 28, 2025-Jeff CoxThe Federal Reserve’s key inflation measure rose more than expected in February while consumer spending also posted a smaller-than-projected increase, the Commerce Department reported Friday.Click here for …

HEI Platform Growth Will Be Fueled by Regulation, Leaders Say

National Mortgage News, March 28, 2025-Spencer LeeDespite ongoing legal scrutiny, leaders at the helm of home equity investment platforms see a silver lining: emerging regulatory clarity that could unlock further …

Burned Homes Can Be Rebuilt More Resilient to Wildfires, but Many Homeowners Can’t Afford the Price

Inside Climate News, March 27, 2025-Diana KruzmanAs the smoke cleared and the ash began to settle from January’s devastating Los Angeles wildfires, an arresting image spread across news and social …

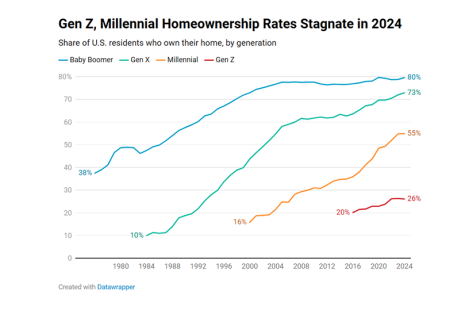

Gen Z, Millennial Homeownership Rates Flat in 2024, Redfin Finds

Redfin, Seattle, found that homeownership rates for Gen Z and millennials were stagnant in 2024.

Institutional Investors Shift Focus to Private Infrastructure, Real Estate

Globe St., March 20, 2025-Philippa Maister Some of the world’s largest institutional investors are considering ways to play the next real estate cycle with a core focus on private infrastructure …