The National Association of Home Builders reported builder confidence inched up in September on lower lumber prices and strong housing demand, even as the housing sector continues to grapple with building material supply chain issues and labor challenges.

Tag: Wells Fargo

Builder Confidence Edges Lower as Material Challenges Persist

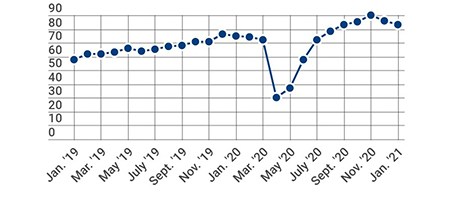

Strong buyer demand partially offset building material supply-side challenges, regulation and labor as builder confidence in the market for newly built single-family homes inched down one point to 80 in July, the National Association of Home Builders/Wells Fargo Housing Market Index reported.

Industry Briefs May 13, 2021

DiversityInc announced its annual list of the Top 50 Companies for Diversity, which serves as a benchmark of how the largest employers in U.S. are doing when it comes to hiring.

Industry Briefs Feb. 25, 2021

Finicity, Salt Lake City, announced its one-touch Mortgage Verification Service, enabling lenders to allow consumers to permission data so lenders can verify assets, income and employment in a single interaction. The verification is accepted by both Freddie Mac and Fannie Mae.

Strong Buyer Demand Keeps Home Builders Optimistic

Strong buyer demand helped offset supply chain challenges and a surge in lumber prices as builder confidence in the market for newly built single-family homes edged up, the National Association of Home Builders reported yesterday.

Builder Confidence Dips from Record Highs, But Stays Strong

Builder confidence in the market for newly built single-family home fell for the first time in three months in December, but remained strongly optimistic, the National Association of Home Builders reported yesterday.

Andrew Foster: CMBS Market Musings

Taken together, the analysis from industry thought leaders indicates that CMBS will continue to have challenges with existing loans through 2021 as new issuance remains robust for agency MBS and at a tepid pace for conduit transactions. Challenges with maturing loans are starting as well; however, 2022 will bring a major wave of those loans.

Andrew Foster: CMBS Market Musings

Taken together, the analysis from industry thought leaders indicates that CMBS will continue to have challenges with existing loans through 2021 as new issuance remains robust for agency MBS and at a tepid pace for conduit transactions. Challenges with maturing loans are starting as well; however, 2022 will bring a major wave of those loans.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s annual multifamily lending market report.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s annual multifamily lending market report.