The Treasury Department issued new guidance Wednesday to increase state, local and tribal governments’ ability to use American Rescue Plan funds to increase affordable housing. The Mortgage Bankers Association commended the Biden administration for its commitment to addressing the ongoing housing shortage.

Tag: Treasury Department

Treasury Department Issues Guidance to Increase Affordable Housing Supply

The Treasury Department issued new guidance Wednesday to increase state, local and tribal governments’ ability to use American Rescue Plan funds to increase affordable housing. The Mortgage Bankers Association commended the Biden administration for its commitment to addressing the ongoing housing shortage.

The FHFA Foreclosure Suspension for Borrowers Applying for Relief through Homeowner Assistance Fund; Implications for Servicers

Pete Mills, Senior Vice President of Residential Policy and Member Services with the Mortgage Bankers Association, cautioned that the policy could have unintended consequences for mortgage servicers.

FHFA Suspends Foreclosure for Borrowers Applying for Relief through Homeowner Assistance Fund

The Federal Housing Finance Agency on Wednesday said Fannie Mae and Freddie Mac will require servicers to suspend foreclosure activities for up to 60 days if the servicer has been notified that a borrower has applied for assistance under the Department of the Treasury’s Homeowner Assistance Fund.

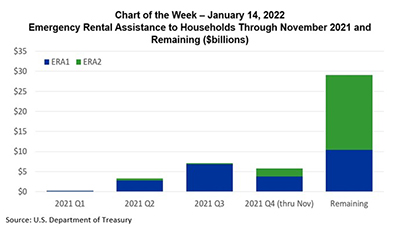

MBA Chart of the Week: Emergency Rental Assistance to Households

On Friday, January 7, the U.S. Department of Treasury released its latest monthly update on allocation of funds from the Emergency Rental Assistance program.

MBA Advocacy Update Sept. 20 2021

On Tuesday, following months of MBA advocacy, the Treasury Department and FHFA suspended certain limits on the business activities of the GSEs. On Wednesday, FHFA also announced a Notice of Proposed Rulemaking to amend the Enterprise Regulatory Capital Framework Rule.

FHFA Issues Proposed Rulemaking to Amend GSE Regulatory Capital Framework

It’s been a busy week for the Federal Housing Finance Agency. On Tuesday, FHFA and the Treasury Department suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac. On Wednesday, FHFA announced a notice of proposed rulemaking to amend the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

FHFA, Treasury Suspend Portions of GSE 2021 Preferred Stock Purchase Agreements

The Federal Housing Finance Agency and the Treasury Department on Tuesday suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac in January.

MBA Mortgage Action Alliance Call to Action Urges Flexibility on GSE Purchase Caps

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action yesterday, asking its members contact their members of Congress to allow flexibility in implementation of new purchase caps placed on Fannie Mae and Freddie Mac.

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.