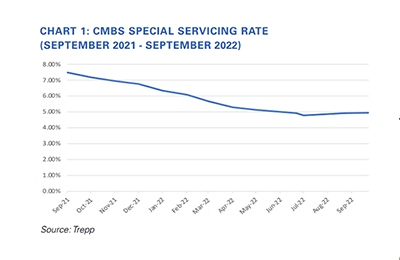

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.

Tag: S&P Global Ratings

Reports Say Commercial Real Estate Well-Positioned to Withstand Ukraine Crisis

The crisis in Ukraine has shaken global markets but is unlikely to directly affect U.S. commercial real estate and financial firms, two reports said.

Commercial/Multifamily Briefs Oct. 18, 2021

S&P Global Ratings said it plans several initiatives about how it assesses environmental, social and governance factors across all sectors globally.

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

Real Estate Investment Trusts Poised For Recovery

S&P Global Ratings, New York, said real estate investment trust earnings rebounded significantly in the second quarter, demonstrating the sector is on the right path for a solid comeback.

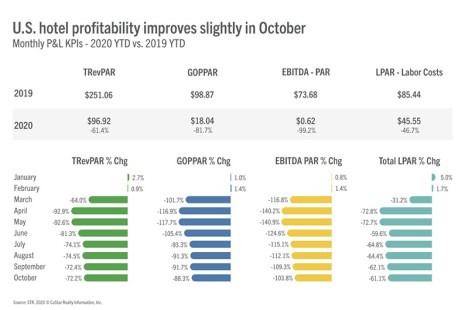

Hotel Sector Recovery Slows

The hotel sector recovery has slowed in recent months after rebounding in the fall from April lows, said Fitch Ratings, New York.

Financial Institutions Face Risks To CRE Asset Quality

S&P Global Ratings, New York, said both banks and non-bank financial institutions face risks from their commercial real estate exposure due to the COVID-19 pandemic’s impact on travel, shopping and office usage.

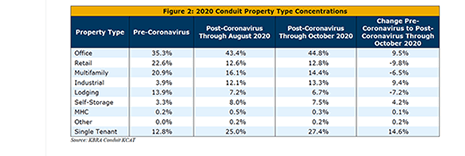

CMBS Delinquency Rate Falls; Issuance Bounces Back

The commercial mortgage-backed securities delinquency rate continued to fall in October while issuance increased, said Trepp LLC and KBRA, New York.

CMBS Servicers Working through Surge in Requests

S&P Global Ratings, New York, said commercial mortgage-backed securities special servicers are working through a “surge” in borrower requests for relief, primarily on lodging and retail properties.

S&P: Retail REITs Could Face Distress Until At Least 2021

S&P Global Ratings, New York, said retail real estate investment trusts, already buffeted by the coronavirus pandemic and dwindling brick-and-mortar revenues, could see an increase in downgrades in coming quarters with little chance of recovery before next year.