ServiceLink’s Marc Bator says adopting Remote Online Notarization isn’t just about keeping pace with technology, “it’s about meeting modern borrower expectations and positioning your organization for long-term success.”

Tag: RON

Multiple Lines of Defense: Combating Fraud in the Digital Closing Era

NotaryCam’s Suzanne Singer writes that as fraudsters innovate, the mortgage industry must respond in kind.

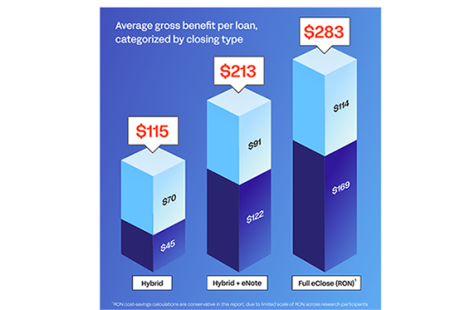

Research Finds Digital Closings Create Up to 10 Basis Point Pricing Advantage

eClosing technology enables lenders to achieve up to a 10 basis point pricing gain by accelerating loan delivery to the secondary and capital markets, according to a new study from Snapdocs and Falcon Capital Advisors.

Brian Webster From NotaryCam: Transforming Home Equity Lending–Why Mortgage Lenders Should Embrace eClosings

Home equity lending is back. According to the Mortgage Bankers Association’s Home Equity Lending Study, originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased by 50% in 2022 compared to 2020.

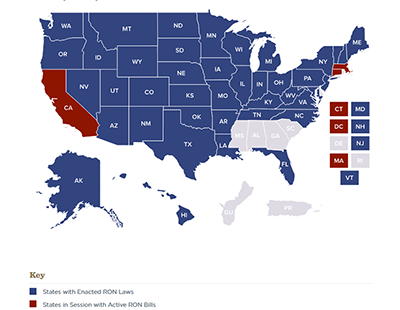

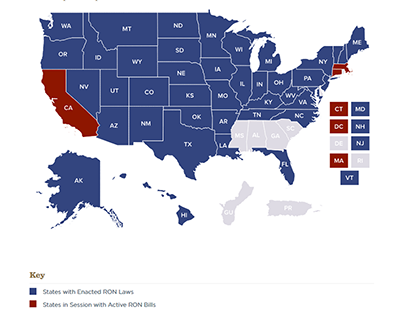

MBA Applauds House Passage of Remote Online Notarization Bill

The House on Wednesday passed legislation that creates federal minimum standards to allow notaries in all states to perform remote online notarization transactions. The Mortgage Bankers Association applauded the news.

MBA Applauds House Passage of Remote Online Notarization Bill

The House on Wednesday passed legislation that creates federal minimum standards to allow notaries in all states to perform remote online notarization transactions. The Mortgage Bankers Association applauded the news.

Mortgage Action Alliance Issues Immediate ‘Call to Action’: Support Nationwide Use of RON

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action Monday supporting bipartisan legislation that would allow notaries in all states to perform Remote Online Notarization transactions.

Chris Lewis of DocMagic: 3 Keys to Moving Forward with RON Now

Remote online notarization is the critical component to the industry’s realization of a truly 100% paperless, fully remote, no-touch mortgage closing. In the journey to deliver a digital lending experience, the offering and acceptance of RON completes a transformation that promises to provide benefits to lenders and the borrowers they serve.

Chris Lewis of DocMagic: 3 Keys to Moving Forward with RON Now

Remote online notarization is the critical component to the industry’s realization of a truly 100% paperless, fully remote, no-touch mortgage closing. In the journey to deliver a digital lending experience, the offering and acceptance of RON completes a transformation that promises to provide benefits to lenders and the borrowers they serve.

Paul Anselmo of Evolve Mortgage Services: Defragmenting the Digital Closing Process

Paul Anselmo is CEO and founder of Evolve Mortgage Services, Frisco, Texas, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries. Previously he served as president, CEO and founder of Mortgage Resource Network (MRN), a business process outsourcer and technology provider to the mortgage industry. In 2019, he was honored as a “Lending Luminary” by the PROGRESS in Lending Association.