Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

Tag: Rocket Mortgage

Industry Briefs Aug. 17, 2021

The Federal Housing Finance Agency released reports providing the results of the 2020 and 2021 annual stress tests Fannie Mae and Freddie Mac under the Dodd-Frank Act.

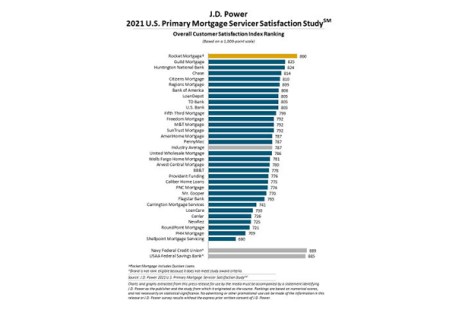

J.D. Power: Mortgage Servicers Get High Marks; Nonbanks Gain Traction

J.D. Power, Troy, Mich., said mortgage servicers earned high levels of customer satisfaction during the pandemic, but warned as loan forbearance programs come to an end and more normalized customer interactions resume, traditional banks are starting to lose their edge over non-bank lenders.

Industry Briefs May 21, 2021

Quicken Loans, Detroit, announced it will officially change its name to Rocket Mortgage on July 31. This change will bring alignment to the overall “Rocket” brand.

Industry Briefs Mar. 30, 2021

Embrace Home Loans, Lehi, Utah, announced plans to roll out SimpleNexus, a homeownership platform for loan officers, borrowers, real estate agents and settlement agents, to more than 300 retail mortgage LOs before the end of the year.

Industry Briefs Feb. 16 2021

LodeStar Software Solutions announced an integration with Mortgage Coach, creator of the Total Cost Analysis Borrower Conversion Platform. This integration allows lenders of any size to include accurate closing provider fees when creating a Total Cost Analysis for borrowers.

Industry Briefs Feb. 3, 2021

Rocket Mortgage, Detroit, launched a national mortgage broker directory, which is prominently displayed on its website.

J.D. Power: Annual Satisfaction Study Reveals ‘Underlying Problems’ in Mortgage Industry

Record-low interest rates and low housing inventories have driven U.S. home sales to a 14-year high and yet another refinancing boom—the Mortgage Bankers Association now estimates 2020 mortgage originations to jump to $3.18 trillion—but it has also exposed underlying weaknesses in lender and servicer strategies, said J.D. Power, Troy, Mich.

Industry Briefs Oct. 15, 2020

FormFree, Athens, Ga., has been granted Patent Number 10,769,723 for its proprietary ‘Systems and Methods for Electronic Account Certification and Enhanced Credit Reporting’ by the United States Patent and Trademark Office.

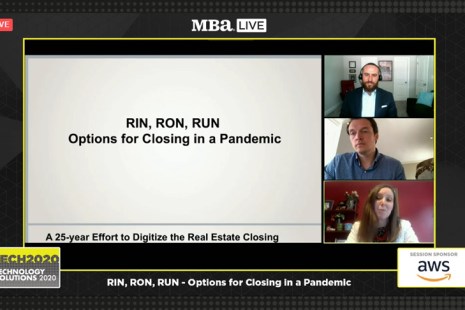

(#MBALive) Closing Loans During a Pandemic With RIN and RON

Enterprising mortgage companies are using what they have to ensure consumers can still obtain loans during the COVID-19 crisis.