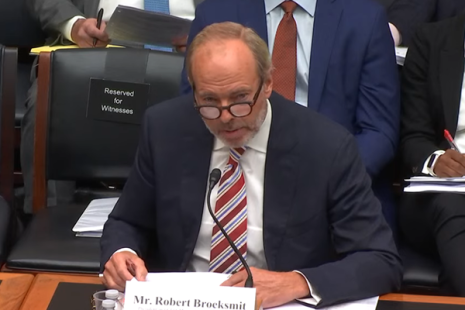

MBA President and CEO Robert Broeksmit, CMB, testified before Congress yesterday. He told the House Financial Services Committee that MBA strongly opposes key elements of the Basel III proposal, which, absent significant revisions, could increase borrowing costs and reduce credit availability.

Tag: Robert Broeksmit CMB

MBA Comments on FHFA’s Credit Scoring Implementation Plan

The Federal Housing Finance Agency announced updates to its implementation plan for the GSEs’ adoption of FICO 10T and VantageScore 4.0 and bi-merge reporting requirements. Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, issued the following comments.

MBA Honors Merchants Bank of Indiana’s Michael Eising with 2023 Ken Markison Legacy Achievement Award

The Mortgage Bankers Association presented its annual Ken Markison Legacy Achievement Award to Michael Eising, CMB, CMCP, Vice President and Mortgage Compliance Manager at Merchants Bank of Indiana.

MBA’s Bob Broeksmit Highlights Federal Advocacy Amid Industry Challenges

WASHINGTON–The mortgage banking industry may be facing some headwinds, but that hasn’t stopped the pace of efforts to advocate for it on Capitol Hill and across federal agencies.

MBA Comments on FHFA’s Credit Scoring Implementation Plan

The Federal Housing Finance Agency yesterday announced updates to its implementation plan for the GSEs’ adoption of FICO 10T and VantageScore 4.0 and bi-merge reporting requirements. Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, issued the following comments.

MBA’s Bob Broeksmit Highlights Federal Advocacy Amid Industry Challenges

WASHINGTON–The mortgage banking industry may be facing some headwinds, but that hasn’t stopped the pace of efforts to advocate for it on Capitol Hill and across federal agencies.

MBA Honors Merchants Bank of Indiana’s Michael Eising with 2023 Ken Markison Legacy Achievement Award

The Mortgage Bankers Association presented its annual Ken Markison Legacy Achievement Award to Michael Eising, CMB, CMCP, Vice President and Mortgage Compliance Manager at Merchants Bank of Indiana.

To the Point With Bob: Rent Control Will Deepen the Affordable Housing Crisis

In a new blog post, MBA President and CEO Bob Broeksmit, CMB, explains why rent control policies will perpetuate the housing supply-demand disconnect.

To the Point With Bob: Rent Control Will Deepen the Affordable Housing Crisis

In a new blog post, MBA President and CEO Bob Broeksmit, CMB, explains why rent control policies will perpetuate the housing supply-demand disconnect.

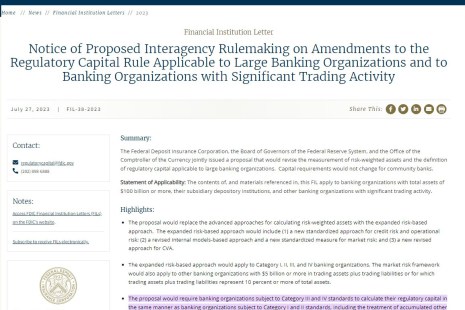

Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. The so-called “end game” proposed rules complete U.S. regulators’ implementation of the Basel III standards and make changes in response to the recent large bank failures. MBA strongly opposes certain provisions of the proposal.