Optimal Blue, Plano, Texas, found lock activity surged in September as rates fell, with total lock volume up 28.2% month-over-month and 21.1% year-over-year.

Tag: Refinances

MCT: Rate/Term Refinances Surge in September

Mortgage Capital Trading, San Diego, released its latest Lock Volume Indices, revealing that rate/term refinances rose by 183.54% on a monthly basis in September.

Ed Austin from SingleSource Property Solutions: Take 2020’s Lessons to Heart And Get Refi-Ready Now

When the COVID-19 pandemic arrived in 2020, the Federal Reserve’s response was swift and its impact on the housing market was dramatic. Millions of homeowners rushed to refinance, sometimes more than once. But for the industry, a golden opportunity also became a logistical nightmare.

SingleSource Property Solutions’ Ed Austin: Take 2020’s Lessons to Heart And Get Refi-Ready Now

When the COVID-19 pandemic arrived in 2020, the Federal Reserve’s response was swift and its impact on the housing market was dramatic. Millions of homeowners rushed to refinance, sometimes more than once. But for the industry, a golden opportunity also became a logistical nightmare.

Take 2020’s Lessons to Heart And Get Refi-Ready Now–Ed Austin of SingleSource Property Solutions

When the COVID-19 pandemic arrived in 2020, the Federal Reserve’s response was swift and its impact on the housing market was dramatic. Millions of homeowners rushed to refinance, sometimes more than once. But for the industry, a golden opportunity also became a logistical nightmare.

Optimal Blue: Rate-and-Term Refinance Locks Up Significantly From 2023

Optimal Blue, Plano, Texas, released its September Market Advantage report, finding a spike in rate-and-term refinance activity.

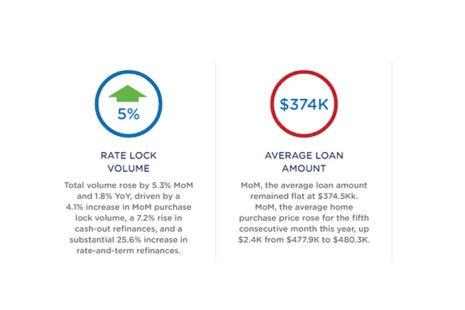

Optimal Blue: Rate-and-Term Refis Jump in May

Optimal Blue, Plano, Texas, released its Market Advantage Mortgage Data Report for May, finding, among other metrics, an almost 26% increase in rate-and-term refinances in May.

ATTOM: Mortgage Lending Drops in Q1

ATTOM, Irvine, Calif., released its first-quarter U.S. Residential Property Mortgage Origination report, revealing that 1.28 million mortgages secured by residential property were issued in the quarter.

Total Expert’s Joe Welu–Retention Is the Key to Winning the 2024 Refi Surge

We knew it was coming—eventually. After 11 rate hikes starting in March 2022, the Fed in December 2023 signaled its intentions to lower rates through 2024. With mortgage rates already dropping, virtually everyone that bought a home in the last 18 months will benefit from a refinancing conversation with their lender.

Fewer Than 1 in 5 With Pre-Pandemic Mortgages Have Refinanced

Despite record low interest rates, just 19 percent of homeowners with a mortgage they had prior to the pandemic have refinanced since COVID-19 started, according to Bankrate.com.