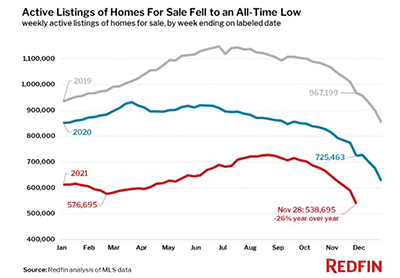

Homes for sale fell to another record low during the week ending November 28, said Redfin, Seattle. Sustained demand pushed the median home price to another record high, and one-third of homes sold in one week or less.

Tag: Redfin

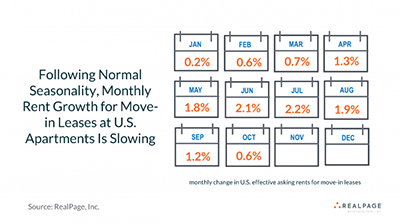

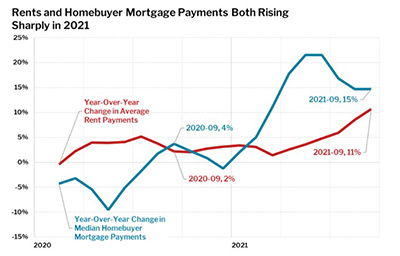

Apartment Rents Up 13% Year Over Year

Apartment rents increased nearly 13 percent nationwide over the past year–the highest rate in at least two years–but growth slowed slightly in October, reports from Redfin and RealPage said.

Housing Market Roundup Nov. 30, 2021

RE/MAX, Denver, said October home sales fell by 6.4 percent from September—nearly double the typical seasonal decline—pinched between a steep median sales price of $336,000 and record low inventory.

Housing Market Cools, But Relief for Homebuyers Short-Lived

Redfin, Seattle, said median home price appreciation slowed again in October, but provided little relief for homebuyers who have seen double-digit price increases over the past two years.

Housing Market Roundup Nov. 22, 2021

Here’s a summary of some of the latest housing and economic reports that have come across the MBA NewsLink desk:

Redfin: More Balanced Housing Market in 2022

It’s mid-November, which means it’s also time for 2022 forecasts. Redfin, Seattle, never shy, says the new year will bring more balance to the housing market. However, don’t expect a buyer’s market—just more selection, less frenzy and slower price growth.

October Second-Home Demand Up 70% From Pre-Pandemic Levels

Redfin, Seattle, said while demand for vacation homes has cooled slightly since the start of the year, it’s expected to remain above pre-pandemic levels as many Americans take advantage of more permanent remote-work policies.

Industry Briefs Nov. 17, 2021: nCino to Acquire SimpleNexus for $1.2 Billion

nCino, Wilmington, N.C., announced it will acquire SimpleNexus, Lehi, Utah, for $1.2 billion.

Redfin: Investors Bought Record 18% of 3Q Homes for Sale

Redfin, Seattle, said real estate investors bought a record 18.2% of the U.S. homes purchased during the third quarter, up from a revised 16.1% in the second quarter and 11.2% a year earlier.

Housing Market Roundup Nov. 9, 2021

We’re starting to get a lot of year-end housing market reports—which means we should be soon getting 2022 forecasts. Here is a roundup of recent reports to come across the MBA NewsLink desk: