Silverwork Solutions, Chicago, a developer of digital workforce BOTs, announced a partnership with Revolution Mortgage, Columbus, Ohio.

Tag: Redfin

Industry Briefs, Jan. 18, 2023: Inflation’s Impact on Small Businesses

Biz2Credit, New York, announced findings of its Small Business Inflation Study that analyzed the revenues and expenditures of more than 140,000 U.S. small businesses from January 2019 to October 2022.

Rent Growth Slows 7th Straight Month

Redfin, Seattle, reported the median U.S. asking rent rose by just 4.8% year over year to $1,979 in December—the smallest increase since July 2021. Despite the slowing, the report said rents grew at more than three times that pace one year earlier.

Record Share of Home Sellers Offer Concessions to Buyers

The housing market’s about-face from a sellers’ market to a buyers’ market played out in stark fashion in the fourth quarter, with a record share of home buyers asking for—and receiving concessions in home sales, said Redfin, Seattle.

Housing Market Roundup: Luxury Home Sales Plummet; Buyers Get Some Leverage Back

Here’s a summary of housing market reports that came across the MBA NewsLink desk over the holidays:

Industry Briefs Dec. 22, 2022: Guild Mortgage Launches Payment Advantage Program

Guild Mortgage, San Diego, introduced Payment Advantage, a new conventional loan program to help homebuyers save on their payments as rates continue to rise.

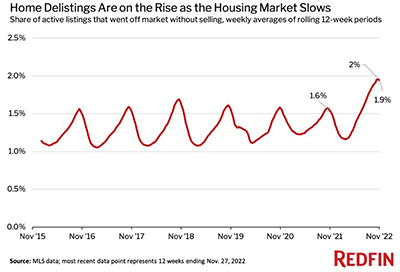

Home Delistings Hit Record High in November as Buyers, Sellers Retreat

The shifting housing market appears to have caught a lot of home sellers by surprise: A record 2% of U.S. homes for sale were delisted each week on average during the 12 weeks ending Nov. 20, compared to 1.6% one year earlier, according to Redfin, Seattle.

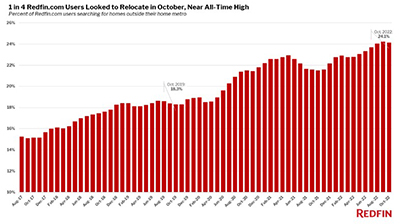

Redfin: Home Relocation Near Record High

The share of Redfin.com users looking to move to a different metro area is near its record high as high rates and prices up the appeal of affordable places.

Redfin: Home Price Growth Cooling in ‘Pandemic Boomtowns’

Home-price growth has slowed fastest in pandemic boomtowns, including Austin, Phoenix and Boise, as high mortgage rates and an uncertain economy deter would-be buyers, said Redfin, Seattle.