This week’s top legislative and policy news from the Mortgage Bankers Association.

Tag: Pete Mills

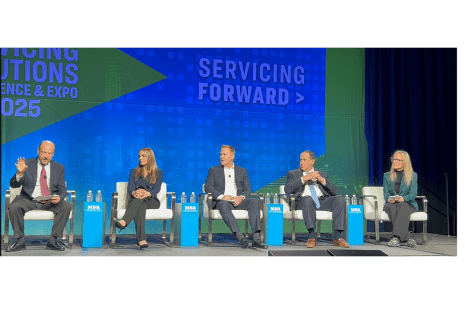

Servicing Panel Talks AI, Insurance, Future Trends

DALLAS–What’s next for the servicing industry when it comes to trends and challenges in technology, regulation and the overall market?

Advocacy Update: MBA Holds GSE Briefing on Capitol Hill; FHFA Nominee Pulte Support Letter, More

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: Trump Administration Nominees Turner, Bessent, and Collins Headed to Senate Floor for Confirmation Votes

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: FHFA Director Nominated; Confirmation Hearing Recaps on Turner, Bessent; FHA Finalizes Loss Mitigation

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: 119th Congress Sworn In; FHA Adopts URLA for Title 1 Programs; MORPAC and MAA Leadership News

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: Congress Passes Stopgap Funding Bill; NFIP Also Extended Until March

The U.S. House and Senate on Friday night passed a Continuing Resolution that averts a government shutdown and extends Fiscal Year 2024 funding levels through March 14, 2025. President Biden signed the measure Saturday.

Advocacy Update: MBA Proposes Ginnie Mae Early-Buyout Securitization; Responds to HUD’s Proposed Flexibilities for Underwriting Rental Income

This week’s top legislative and policy news from the Mortgage Bankers Association.

Advocacy Update: Trigger Leads Bill Dropped from Conference Report; Broeksmit on GSE Reform; MBA Presses HUD MRB on Convenience Fees

This week’s top legislative and policy news from the Mortgage Bankers Association.