This week’s top legislative and policy news from the Mortgage Bankers Association.

Tag: Pete Mills

MBA Advocacy Update

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: Federal Reserve Maintains Federal Funds Rate; Treasury Secretary Yellen Unveils “Green Book,” Defends Biden FY2025 Budget Proposal

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: Court Grants Preliminary Approval of NAR Settlement; CFPB Publishes Supervisory Highlights on Mortgage Servicing; MBA Takes Exception to Misleading Press Release

This week’s top legislative and policy news from the Mortgage Bankers Association.

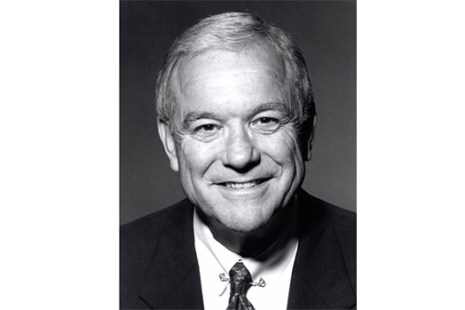

Industry Leader John B. Johnson Passes Away

John B. Johnson passed away last week at 84. He was a long-time leader in the industry and co-founder and CEO of MortgageAmerica Inc. from 1978 to 2012.

MBA Advocacy Update April 22: GSEs Confirm Existing Policy on Interested Party Contributions

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update April 15: VA Releases VASP Program; House Hearings Demonstrate Tax Debate on Expiring Provisions Well Underway

This week’s top legislative and policy news from the Mortgage Bankers Association.

Advocacy Update: MBA Urges VA to Amend Regulations on Buyer Agent Commissions; FHFA’s Title Pilot Sparks Concerns; MAA Call to Actions in Mass. and Fla.

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: MBA Releases Webinar on Real Estate Commission Lawsuit Settlement; CFPB News

This week’s top legislative and policy news from the Mortgage Bankers Association.

MBA Advocacy Update: Federal Spending Package Signed into Law; Real Estate Commission Lawsuit Settlement Update

This week’s top legislative and policy news from the Mortgage Bankers Association.