When COVID-19 hit in mid-March, apartment operators quickly cut rents as demand evaporated. Today leasing volumes are “surging” and rent cuts are disappearing quickly in most big U.S. metros, reported RealPage, Richardson, Texas.

Tag: Multifamily

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

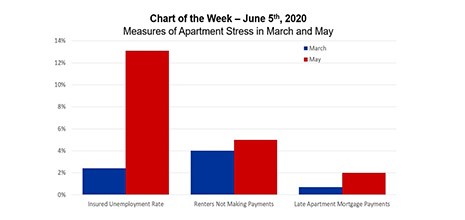

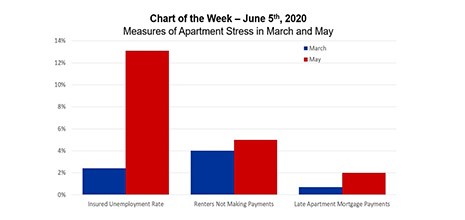

MBA Chart of the Week: Measures of Apartment Stress in March and May

There has been an important disconnect between the labor market and apartment markets over the last two months.

MBA Chart of the Week: Measures of Apartment Stress in March and May

There has been an important disconnect between the labor market and apartment markets over the last two months.

HUD/Census: Nearly Half of Rental Units Are in Small Multifamily Properties

Nearly half of the nation’s 48.2 million rental housing units are in properties with less than five units, HUD and the U.S. Census Bureau reported. For these small rental properties, …

Coronavirus Causes Biggest Multifamily Rent Growth Slowdown in Years

Apartment rent prices slowed more in April than in several years when the coronavirus pandemic hit, the April Zillow Real Estate Market Report said.

Multifamily Leasing Bounces Back

New apartment lease signings “clawed back” to year-ago levels in late April after plunging nearly 50 percent in late March, reported RealPage, Richardson, Texas.

Multifamily Market Musings: A Q&A With PGIM’s Mike McRoberts

MBA NewsLink interviewed PGIM Real Estate Finance Managing Director Mike McRoberts, who serves as Chairman of the firm’s Agency platform.

HUD Announces New CARES Act Mortgage Payment Relief Guidance

HUD announced new mortgage payment relief guidance under the CARES Act for borrowers with multifamily mortgages insured by FHA or borrowers participating in other HUD multifamily housing programs.

House Approves $2 Trillion Stimulus Bill; Trump Signs into Law

The House on Friday approved a massive $2 trillion stimulus bill aimed at injecting a much-needed boost to a U.S. economy that has been staggered by the coronavirus pandemic.