With interest rates soaring, most lenders are struggling to generate enough profit from originations to sustain business. And when they are incurring losses with each loan originated, many have turned their attention to mortgage servicing rights for extra revenue.

Tag: Mortgage Servicing Rights

Pamela Hamrick of Incenter Diligence Solutions: Elevating QC to a Growth Leader

Just before Labor Day, Fannie Mae instituted new prefunding quality control review requirements, leading to larger discussions of the financial impact of QC processes on mortgage lenders. MBA NewsLink asked Pamela Hamrick, President, Incenter Diligence Solutions, to elaborate.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

ServiceMac’s Bob Caruso: Take Advantage of a Heightened MSR Purchase/Transfer Market

As interest rates remain high and the long-term market outlook is uncertain, lenders are evaluating strategies to strategically grow their mortgage portfolios. As a result, many organizations are selling off portfolios to aggregators, which has led to a heightened level of mortgage servicing rights (MSR) purchases and transfers. For lenders looking to purposefully grow their mortgage portfolios, the increase in MSR activity presents a unique opportunity.

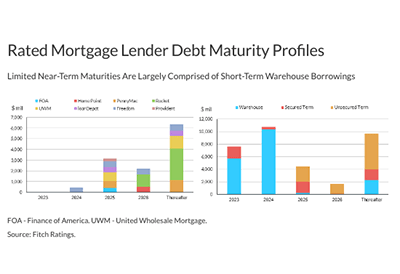

Fitch Ratings: Non-Bank Mortgage Lenders to Withstand Liquidity, Funding Pressures

U.S. non-bank mortgage companies are positioned to withstand liquidity and funding pressures amid the fallout from recent bank failures, growing recessionary risks and tightening lending standards, reported Fitch Ratings, New York.

Incenter’s Piercy, Dowell and Hamrick: Optimizing MSR Trades While Minimizing Risks

Mortgage servicing rights trading has remained brisk thus far in 2023. To help buyers and sellers capitalize on this important strategy while minimizing their risks, MBA NewsLink interviewed Tom Piercy, Managing Director, and Bob Dowell, Managing Director, Analytics, with Incenter Mortgage Advisors and Pamela Hamrick, President of Incenter Diligence Solutions.

Susan Graham of FICS: Retaining Servicing Provides Competitive Advantage to Lenders in Challenging Mortgage Market

Servicing retention generates servicing fee income and helps servicers improve the customer experience. Modern loan servicing software automates investor reporting and compliance and creates a more efficient workflow, allowing servicers to effectively service loans in-house.

Susan Graham of FICS: Retaining Servicing Provides Competitive Advantage to Lenders in Challenging Mortgage Market

Servicing retention generates servicing fee income and helps servicers improve the customer experience. Modern loan servicing software automates investor reporting and compliance and creates a more efficient workflow, allowing servicers to effectively service loans in-house.