There is no downplaying the destruction the COVID-19 pandemic has had on our economy and the financial lives of millions of Americans. But it is also threatening the up-and-coming generation of home buyers, particularly minorities.

Tag: Mortgage-Backed Securities

Richard Ferguson: Preserving Down Payment Options in a Disruptive Market

There is no downplaying the destruction the COVID-19 pandemic has had on our economy and the financial lives of millions of Americans. But it is also threatening the up-and-coming generation of home buyers, particularly minorities.

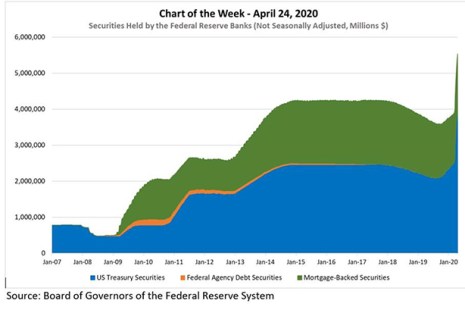

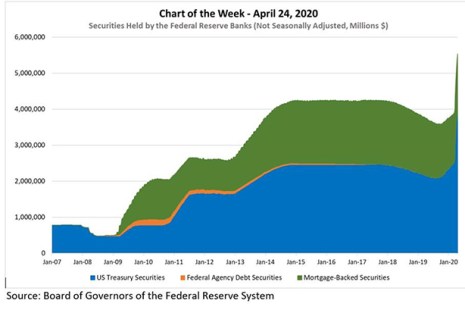

MBA Chart of the Week: Securities Held by Federal Reserve Banks

The MBA Chart of the Week shows the evolution of securities held outright by the Federal Reserve Banks since 2007.

MBA Chart of the Week: Securities Held by Federal Reserve Banks

The MBA Chart of the Week shows the evolution of securities held outright by the Federal Reserve Banks since 2007.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: Fannie Mae, Freddie Mac to Use 4-Month Advance Limit for Loans in Forbearance

The Federal Housing Finance Agency yesterday said it aligned Fannie Mae and Freddie Mac policies regarding servicer obligations to advance scheduled monthly principal and interest payments for single-family mortgage loans.

Fed Announces Additional $2.3 Trillion in Government Loan Facilities

The Federal Reserve yesterday announced a dramatic increase to the scale and scope of its mortgage-backed securities purchases, providing up to $2.3 trillion in new loans to support the economy to bolster the ability of state and local governments to deliver services during the coronavirus pandemic.

Fed Announces Additional $2.3 Trillion in Government Loan Facilities

The Federal Reserve this morning announced a dramatic increase to the scale and scope of its mortgage-backed securities purchases, providing up to $2.3 trillion in new loans to support the economy to bolster the ability of state and local governments to deliver services during the coronavirus pandemic.

MBA Raises Concerns with SEC on Broker-Dealer Margin Call Volatility

The Mortgage Bankers Association, in a letter Sunday to the Securities and Exchange Commission and the Financial Industry Regulatory Authority, raised “urgent concern” about dramatic price volatility in the market for agency mortgage-backed securities over the past week that leading to broker-dealer margin calls on mortgage lenders’ hedge positions that are unsustainable for many such lenders.