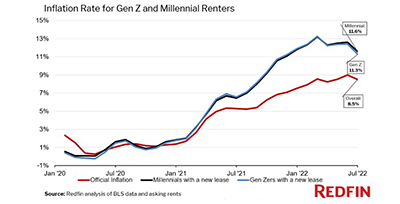

Millennials who took on a new rental lease in July saw their overall cost of goods and services increase 11.6% year over year, substantially higher than 8.5% for the U.S. population as a whole, said Redfin, Seattle.

Tag: Millennials

Millennial Demand Drives Price Increases in Kid-Friendly Neighborhoods

Zillow, Seattle, said home values are growing fastest in areas with the highest share of kids, reflecting the impact Millennials are having on family-friendly neighborhoods with a shortage of available homes.

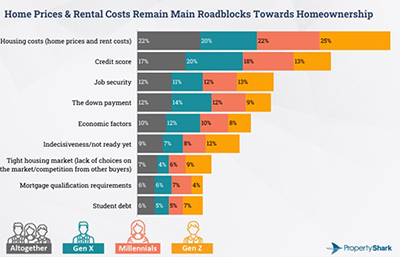

Millennials, Gen Z Continue to Lag Behind in Homeownership

Millennials and Gen Z—the most underrepresented cohorts in homeownership—continue to lag behind after nearly two years into the coronavirus pandemic, according to a survey by PropertyShark, New York.

When Baby Boomers, Millennials Compete for Homes, Boomers Usually Win

The two largest population cohorts in the U.S.—Baby Boomers and Millennials—are competing for scarce supply of homes in most markets. And, according to an analysis by Zillow, Seattle, Boomers are winning in most cases.

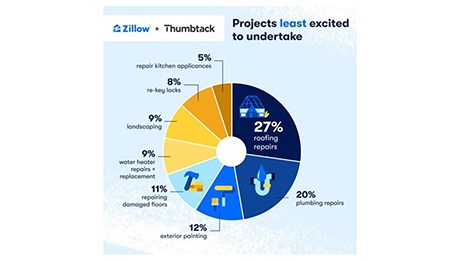

New Homeowners Can Spend Nearly $30K on Unexpected but Common Projects

For most homeowners, buying a home involves more than a mortgage. Research from Thumbtack, San Francisco, and Zillow, Seattle, said a typical for-sale home could need as much as $30,000 in work—which, for some buyers, particularly millennials—might result in unexpected expense.

One-Third of Millennial Homebuyers Using Extra Savings from Pandemic for Down Payment

For nearly one-third (31%) of millennial first-time homebuyers, the ability to save extra money during the coronavirus pandemic helped them accumulate the money needed for a down payment, said Redfin, Seattle.

Generation Z Renters Moving On Up

More young adults are returning to the rental market reported Zillow, Seattle.

‘Urgent Need, Untapped Opportunity’ in Family-Oriented Rental Housing

Family-oriented rental housing supply has fallen behind other multifamily options as developers focus on young, often single renters rather than families who require larger units, said the Urban Land Institute and RCLCO.

Survey: Pandemic Forces Nearly Half of Renters to Postpone Homeownership Plans

RentCafe, Santa Barbara, Calif., said its survey of 7,000 renters found although one in 10 renters planned to by a home in 2020, nearly half have now delayed those plans because of the economic impact of the coronavirus pandemic.

TransUnion: Coronavirus Giving Millennials Toughest Financial Challenges

The COVID-19 pandemic is causing similar financial hardship for consumers around the world, but new research from TransUnion, Chicago, shows Millennials are being challenged the most.