Join us for an educational webinar to explore the unique housing challenges and emerging trends that millennials and Gen Z homebuyers face.

Tag: Millennials

CONVERGENCE: Strategies for Serving Millennial and Gen Z Homebuyers Nov. 2

Join us for an educational webinar to explore the unique housing challenges and emerging trends that millennials and Gen Z homebuyers face.

Zillow: Younger Generations Believe in Homeownership, But Don’t Know How To Achieve It

The American dream of homeownership is not dead for Generation Z and Millennials, but they believe their path to get there will be challenging and may require some luck, reported Zillow, Seattle.

Zillow: Younger Generations Believe in Homeownership, But Don’t Know How To Achieve It

The American dream of homeownership is not dead for Generation Z and Millennials, but they believe their path to get there will be challenging and may require some luck, reported Zillow, Seattle.

David Arnett of Cherry Creek Mortgage: Engaging Millennials and Single Women Despite a Down Market

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

David Arnett of Cherry Creek Mortgage: Engaging Millennials and Single Women Despite a Down Market

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

David Arnett of Cherry Creek Mortgage: Engaging Millennials and Single Women Despite a Down Market

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

David Arnett of Cherry Creek Mortgage: Engaging Millennials and Single Women Despite a Down Market

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

David Arnett of Cherry Creek Mortgage: Engaging Millennials and Single Women Despite a Down Market

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

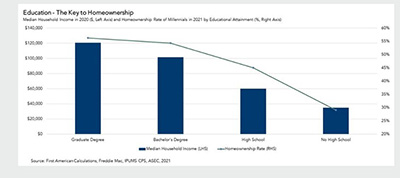

Educated Millennials Hold Key to Future Homeownership Demand

First American Financial Corp., Santa Ana, Calif., said in challenging housing market conditions with higher interest rates, certain fundamentals will drive future growth. One such driver, said First American Deputy Chief Economist Odeta Kushi, is level of education.