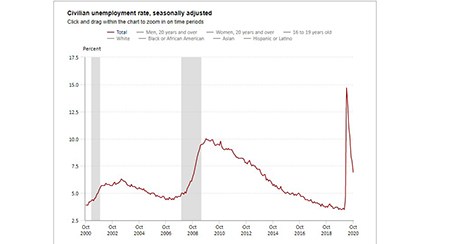

The economy continued its high-low pattern in Friday’s employment report from the Bureau of Labor Statistics. While total nonfarm payroll employment rose by a strong 638,000 in October, and the unemployment rate fell to 6.9 percent, both numbers reflect the devastating economic effects of the coronavirus pandemic.

Tag: Mike Fratantoni

Fed Sends ‘Loud and Clear’ Message on Low Rates

There were no real surprises coming out of yesterday’s Federal Open Market Committee meeting—there haven’t been for months, now—but according to Mortgage Bankers Association Chief Economist Mike Fratantoni, the message it sent was loud and clear.

FOMC Headline HERE

FOMC lede sentence HERE

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent for the week ending October 30, 2020 compared to one week earlier, the Mortgage Bankers Association reported this morning.

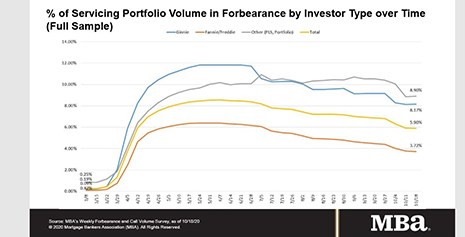

Share of Mortgage Loans in Forbearance Decreases to 5.83%

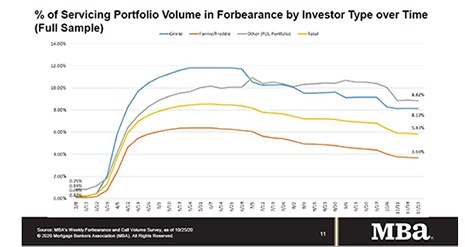

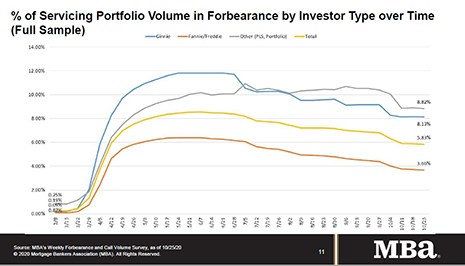

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

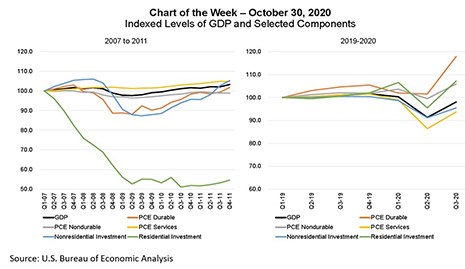

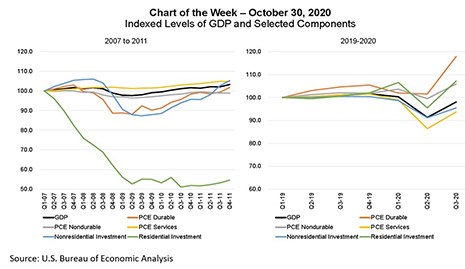

MBA Chart of the Week: Indexed Levels of GDP

This week’s chart compares the 2008-2010 Great Recession (left), to the recent pandemic-driven recession (right), to illustrate the differences in consumer spending and in both nonresidential and residential investment.

MBA Chart of the Week: Indexed Levels of GDP

This week’s chart compares the 2008-2010 Great Recession (left), to the recent pandemic-driven recession (right), to illustrate the differences in consumer spending and in both nonresidential and residential investment.

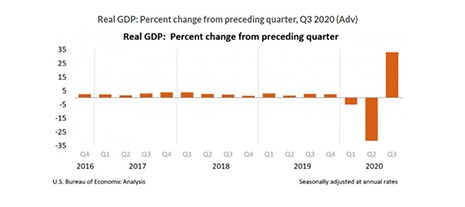

Economy Shows Hint of Recovery

What goes down must come up: after the coronavirus resulted in a staggering record drop in the second quarter, the U.S. economy bounced back somewhat in the third quarter, according to the first (advance) estimate of gross domestic product.

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.