With the economy still suffering and a sharp uptick in coronavirus cases nationwide, the Federal Open Market Committee was widely expected to hold the line during its two-day policy meeting that ended yesterday. And it did.

Tag: Mike Fratantoni

Fed Stays the Course: Monetary Policy ‘Quite Supportive for Housing, Mortgage Markets’

With the economy still suffering and a sharp uptick in coronavirus cases nationwide, the Federal Open Market Committee was widely expected to hold the line during its two-day policy meeting that ended yesterday. And it did.

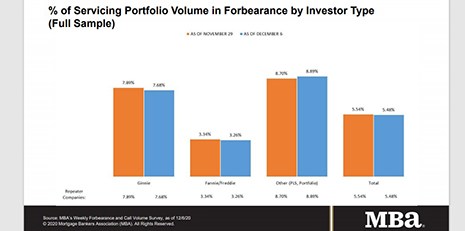

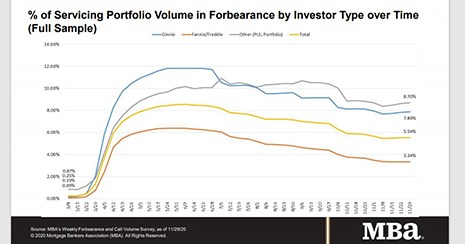

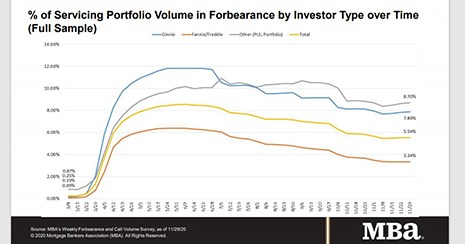

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

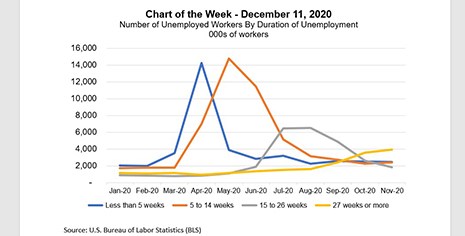

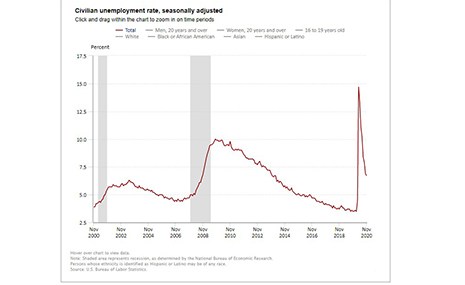

MBA Chart of the Week: Number of Unemployed Workers By Duration of Unemployment

Over the past three months, the pace of job gains has slowed from the rapid recovery seen over the summer. Similarly, the unemployment rate continues to decline, but at a more gradual pace.

MBA Chart of the Week: Number of Unemployed Workers By Duration of Unemployment

Over the past three months, the pace of job gains has slowed from the rapid recovery seen over the summer. Similarly, the unemployment rate continues to decline, but at a more gradual pace.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

Longtime Industry Executive, Advisor Gene Spencer Passes Away

Gene Spencer, who spent 28 years at Fannie Mae and 10 years with the Homeownership Preservation Foundation and who served in a number of advisory capacities with the Mortgage Bankers Association and other industry organizations, passed away on Nov. 30 in Gloucester Point, Va.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

Job Growth Slows Heading into Uncertain Winter

Total nonfarm payroll employment growth slowed to 245,000 in November, the Bureau of Labor Statistics reported Friday, with nearly 10 million fewer jobs currently compared to a year ago.