The Mortgage Bankers Association’s updated Economic Forecast projects 2021 purchase originations are on track to grow by 16.4% to a record $1.67 trillion.

Tag: Mike Fratantoni

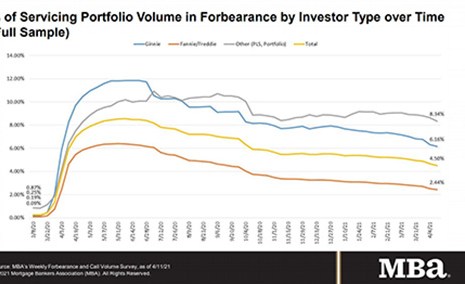

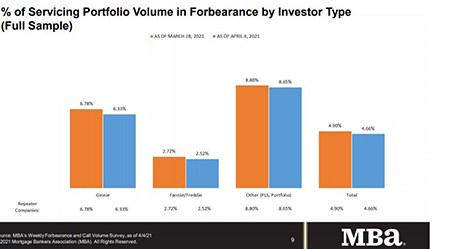

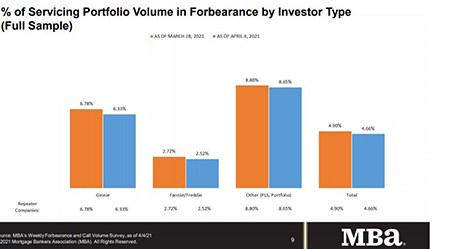

MBA: Share of Mortgage Loans in Forbearance Decreases to 4.50%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 4.5% of servicers’ portfolio volume as of Apr. 11 from 4.66% the prior week. MBA estimates 2.3 million homeowners are in forbearance plans.

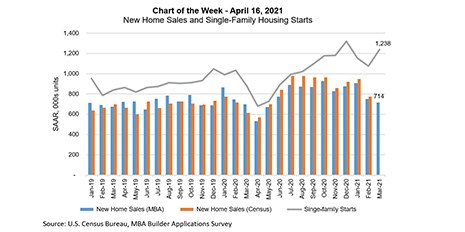

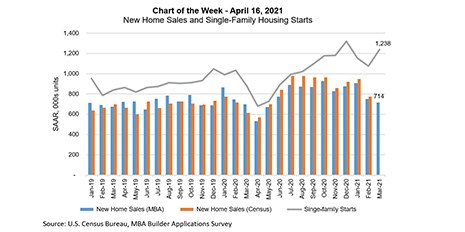

MBA Chart of the Week: New Home Sales, Single-Family Housing Starts

This week’s MBA Chart of the Week focuses on newly built homes, as measured by new home sales and single-family housing starts.

MBA Chart of the Week: New Home Sales, Single-Family Housing Starts

This week’s MBA Chart of the Week focuses on newly built homes, as measured by new home sales and single-family housing starts.

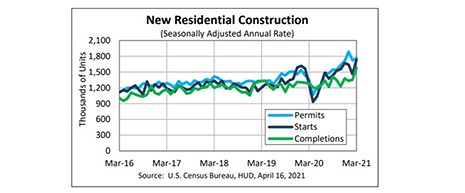

March Housing Starts Post at Highest Rate in 15 Years

Housing starts recovered from a sluggish February to its highest rate since 2006 in March, HUD and the Census Bureau reported Friday.

The Week Ahead—Apr. 19, 2021

Good morning! The Mortgage Bankers Association’s Spring Conference & Expo is upon us!

MBA: Loans in Forbearance Fall 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 24 basis points to 4.66% of servicers’ portfolio volume as of Apr. 4, from 4.90% the prior week. MBA now estimates 2.3 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 24 basis points to 4.66% of servicers’ portfolio volume as of Apr. 4, from 4.90% the prior week. MBA now estimates 2.3 million homeowners are in forbearance plans.

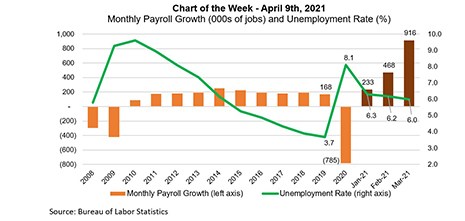

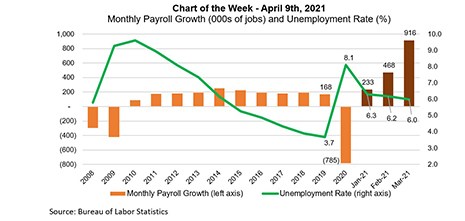

MBA Chart of the Week Apr. 12 2021: Monthly Payroll Growth/Unemployment Rate

This week’s chart summarizes the recent strength of the job market. According to the Bureau of Labor Statistics, job growth accelerated sharply in March, as the economy gained 916,000 jobs over the month, the largest monthly gain since August 2020.

MBA Chart of the Week Apr. 12 2021: Monthly Payroll Growth/Unemployment Rate

This week’s chart summarizes the recent strength of the job market. According to the Bureau of Labor Statistics, job growth accelerated sharply in March, as the economy gained 916,000 jobs over the month, the largest monthly gain since August 2020.