SAN DIEGO–Welcome to the Mortgage Bankers Association’s Commercial/Multifamily Finance Convention & Expo, running through Wednesday, Feb. 16. More than 2,400 commercial/multifamily real estate finance professionals are here at the Manchester Grand Hyatt.

Tag: Mike Flood

A Sneak Peak at MBA CREF22

After a virtual conference in 2021, join more than 2,400 of your commercial real estate colleagues in person next week for the MBA Commercial/Multifamily Finance Convention & Expo.

A Sneak Peak at MBA CREF22

After a virtual conference in 2021, join more than 2,400 of your commercial real estate colleagues in person next week for the MBA Commercial/Multifamily Finance Convention & Expo.

MBA Promotes Bruce Oliver, Laura Hopkins

The Mortgage Bankers Association promoted Bruce Oliver to Vice President of Commercial and Multifamily Policy and Laura Hopkins to Vice President of Member Relations.

MBA Promotes Bruce Oliver, Laura Hopkins

The Mortgage Bankers Association promoted Bruce Oliver to Vice President of Commercial and Multifamily Policy and Laura Hopkins to Vice President of Member Relations.

MBA Submits Comments on FHFA Proposed GSE 2022-2024 Housing Goals

The Mortgage Bankers Association on Monday submitted comments to the Federal Housing Finance Agency on its proposed rule for 2022-2024 housing goals for Fannie Mae and Freddie Mac.

Update: House, Senate Pass Continuing Resolution, Avoid Shutdown; Chopra Confirmed as CFPB Director

Congress on Thursday passed a nine-week Continuing Resolution, avoiding controversial sticking points, to fund the federal government through December 3, avoiding yet another potentially disastrous government shutdown.

Government Shutdown Looming – Potential Implications for the Mortgage Industry

As of this morning (Sept. 30), Congress is still debating a continuing resolution that would extend funding for federal government operations. As this is happening, federal agencies are preparing for the possibility of a shutdown when the current funding expires at 11:59 p.m. ET.

MBA, Trade Groups Urge HUD to Address FHA Affordable Housing Delays

The Mortgage Bankers Association and a dozen industry trade groups urged HUD to address “severe processing delays” that are impeding financing of affordable housing in the Federal Housing Administration multifamily and healthcare programs.

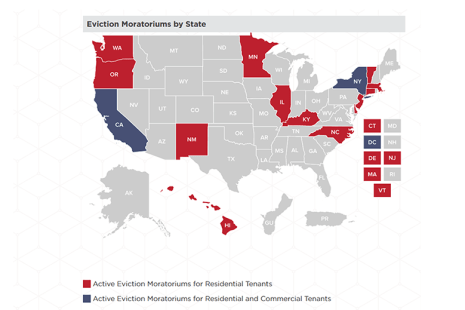

CDC Extends National Residential Eviction Moratorium for Final Time to July 31

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.