TransUnion, Chicago, released its Q4 2024 Quarterly Credit Industry Insights Report, predicting multiple credit products will see growth this year. For mortgages specifically, the report anticipated a 13.3% year-over-year origination growth.

Tag: Michele Raneri

FOMC Holds Rates Steady

The Federal Open Market Committee held interest rates steady yesterday–as many forecasters had predicted.

TransUnion: Credit Card, Unsecured Personal Loan Balances at or Near Record Levels

TransUnion, Chicago, said consumers are increasingly turning to credit to manage their household budgets in the current economic environment, leading to record- or near-record high balances in credit cards and unsecured loans.

Fed Adds 25 Basis Points to Federal Funds Rate

The Federal Open Market on Wednesday raised the federal funds rate by another 25 basis points, a move widely anticipated by analysts and financial markets.

Inflation Spurs Consumers to Credit Cards, Home Equity

TransUnion, Chicago, said amid rising interest rates and high inflation, the fourth quarter saw consumers continuing to look to credit as a means to help stave off financial pressures.

Ramp it Up: Fed Hikes Rates by 75bps for 3rd Straight Meeting

The Federal Open Market Committee raised the federal funds rate by another 75 basis points Wednesday to 3-3.25 percent, the third consecutive such increase and the fifth increase since March.

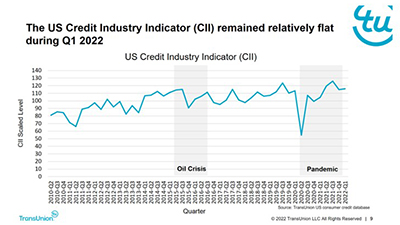

Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.